Understanding Economic Cycles: Booms and Busts Explained

In the complex world of macroeconomics, the ebb and flow of economic cycles play a crucial role in shaping global prosperity and downturns. These cycles, characterized by alternating periods of economic expansion and contraction, influence financial markets, employment rates, and the overall economic health of nations. This article aims to demystify the mechanics of economic cycles, offering a comprehensive understanding of their causes, effects, and the strategies to navigate through these inevitable fluctuations.

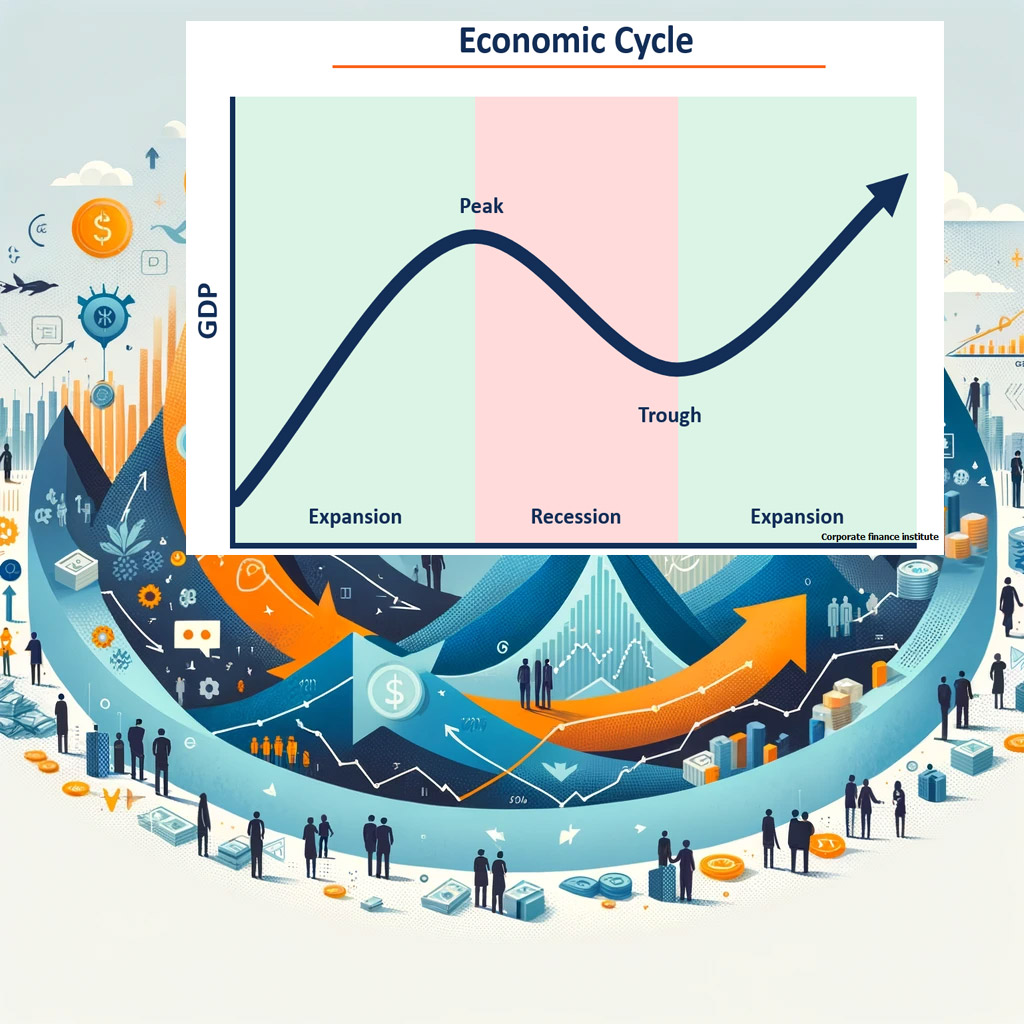

Definition and Phases of Economic Cycles

Economic cycles, also known as business cycles or financial cycles, consist of four main phases: expansion, peak, contraction, and trough. During the expansion phase, economic activity is on the rise, marked by increased production, employment, and consumer spending. This period of economic growth eventually reaches a peak, signaling the highest point of economic activity before a downturn. Following the peak, the economy enters the contraction phase, where economic activity slows down, leading to decreased production, rising unemployment, and reduced consumer spending. The contraction phase bottoms out at the trough, the lowest point of economic activity, setting the stage for recovery and the start of a new cycle.

Historical Examples of Significant Booms and Busts

Throughout history, the global economy has experienced numerous significant booms and busts, each leaving a distinct mark on the world's financial and social fabric. One of the most catastrophic was the Great Depression of the 1930s, which originated in the United States but quickly spread globally, leading to widespread unemployment, severe deflation, and economic stagnation. This period underscored the vulnerabilities in the financial system and led to significant changes in economic policy and regulation.

Another notable example is the dot-com bubble of the late 1990s. During this period, excessive speculation in internet-based companies, fueled by investor enthusiasm and abundant venture capital, led to skyrocketing stock prices. The bubble burst in the early 2000s, causing a significant stock market crash and leading to the bankruptcy of many tech companies, illustrating the dangers of speculative excess.

The 2007-2008 global financial crisis, triggered by the collapse of the housing bubble in the United States, resulted in a severe worldwide economic downturn. The crisis highlighted the interconnectedness of global financial markets and led to widespread calls for stricter financial regulation and oversight. Each of these historical events serves as a stark reminder of the boom and bust nature of economic cycles, emphasizing the need for vigilance and sound economic policy to mitigate the impacts of future downturns.

Causes and Triggers of Economic Cycles

The causes of economic cycles are multifaceted, involving a combination of internal economic dynamics and external shocks. Internal factors include fluctuations in investment spending by businesses, variations in consumer demand, and changes in government spending and taxation policies. External shocks, such as oil price spikes, financial crises, and geopolitical events, can also precipitate economic downturns or spur growth. Furthermore, monetary policy, enacted by central banks through adjustments in interest rates and money supply, plays a pivotal role in influencing the pace of economic activity.

The Role of Government Policy in Managing Economic Cycles

Governments and central banks employ fiscal and monetary policies to mitigate the effects of economic cycles and promote stable growth. Fiscal policy, involving adjustments in government spending and taxation, aims to influence the level of economic activity during different phases of the cycle. During downturns, governments may increase spending or reduce taxes to stimulate growth. Conversely, in periods of rapid expansion, they may reduce spending or increase taxes to prevent overheating. Monetary policy, which includes controlling interest rates and regulating the money supply, is used to manage inflation and influence economic growth. By lowering interest rates, central banks can encourage borrowing and investment during contractions, while raising rates can help cool off an overheating economy.

Impact of Economic Cycles on Different Sectors and Demographics

Economic cycles have varying impacts on different sectors of the economy and demographics. Industries such as construction and manufacturing are highly sensitive to economic fluctuations, experiencing rapid growth during booms and significant downturns during recessions. Service-oriented sectors, however, may be more resilient to economic shifts. Demographically, economic downturns tend to disproportionately affect lower-income groups and younger workers, who may face higher rates of unemployment and underemployment.

Strategies for Businesses and Individuals to Navigate Economic Cycles

Businesses and individuals can adopt various strategies to navigate the ups and downs of economic cycles. For businesses, diversifying product lines, managing debt levels, and maintaining flexible operational structures can provide resilience during downturns. Individuals can safeguard their financial well-being by building emergency savings, investing wisely, and acquiring skills that are in demand across economic cycles. Anticipating and preparing for the inevitable shifts in economic conditions can help mitigate the adverse effects of downturns and capitalize on the opportunities presented during expansions.

Conclusion

Understanding economic cycles is essential for policymakers, investors, business professionals, and the general public alike. By examining the causes, phases, and impacts of these cycles, as well as employing strategic measures to navigate them, stakeholders can better prepare for the inevitable fluctuations that characterize our economic landscape. Through informed decision-making and adaptive strategies, it is possible to mitigate the adverse effects of economic downturns and foster sustainable growth and prosperity.

This exploration of economic cycles not only sheds light on the dynamic nature of financial markets but also underscores the importance of proactive and informed economic planning. As we continue to navigate through the complexities of global economies, a deep understanding of economic cycles will remain a crucial tool in our collective endeavor to achieve stability and prosperity in an ever-changing economic environment.

Economics