Net Asset Value or NAV is defined as the per-unit price specified for the mutual fund scheme. In other words, NAV is the price at which an investor buys a mutual fund from the primary market, i.e., a unit of a mutual fund purchased from an asset management company - Asset management company (AMC). The price will then be called NAV or Net Asset Value of that fund. The increase in NAV at previous levels indicates that the fund is making a profit, while the decrease in Net Asset Value indicates that the fund's investment has to suffer.

For a basic understanding of a mutual fund, we must first understand the accounting principles behind it in which, among other things, plans are evaluated and net asset values are calculated. Net Asset Value or NAV Mutual Fund is the highest price per unit.

If we understand from one example, suppose you buy 100 units of a mutual fund for Rs 1000 then we have to get the NAV or Net Asset Value of it. If the purchase is NAV then you have Net Asset Value of 10 rupees tomorrow if you have Net Asset Value of Rs 15 then some of your asset value will be Rs 1500.

Mutual Fund NAV vs Stock Price:

However, the main difference between share price and NAV is that stock price fluctuates during stock market trades whereas unlike the stock price, mutual fund's NAV does not change throughout the day. The Net Asset Value changes every day. It is calculated after the close of the market. Therefore, it is very important for an investor to know when the purchase price or redemption price of the fund can change. For example, if you are buying a fund today, its NAV will be in line with tomorrow, meaning that its unit will get it according to the Net Asset Value of the next day.

Calculate NAV - How to Calculate NAV of Mutual Fund

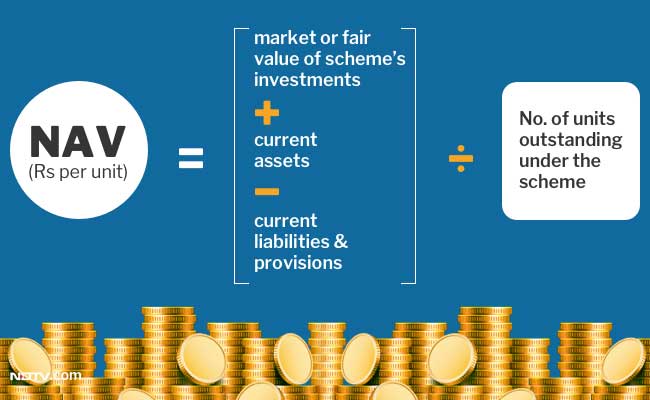

The mutual fund unit's NAV changes daily and the reason is in the fund that calculates the NAV of a fund. The formula for NAV calculation is as follows:

NAV = (Total Assets of the Fund - Total Liabilities of the Fund) / Total Number of Units outstanding.

Total assets of mutual funds are obtained by calculating the total value of all stocks, bonds, cash, futures, treasury bills, ETFs, etc. On the other hand, mutual fund liabilities include securities transaction fees, the total value of pending requests, etc. The total number of outstanding units also changes from time to time. The reason is that the units whose mutual funds could have been released earlier have come down over time as existing investors may have redeemed the units. That is why the calculation is taken into account only the outstanding units of the fund.

For example, suppose the total assets of a mutual fund are Rs 25000 and the liabilities are 5000 and the number of outstanding units is 2000. In this case,

NAV of the fund = (25000 - 5000) / 2000 = Rs.10.

Why calculate once a day Nav? -Why Net Asset Value Changes Only Once a Day

As mentioned earlier, the fund's Net Asset Value is calculated on the basis of total assets, liabilities and outstanding units of the fund. But this calculation is not as simple as the example given in the previous section. The first issue to consider is the number of securities/bonds, etc., in which the funds are invested. While some mutual funds may have less than 10 investments in their portfolio, other schemes may have more than 100 or more. After that, you have to take into account the number of shares of each security or the total amount of each bond of the fund is invested. In addition, the value of securities and bonds during the trading day can change the complexity of Net Asset Value every second or even faster.

Consider this - a fund has been invested in A, B, C and D numbers 100, 200, 300 and 400 shares respectively. Now if the fund manager decides to sell 100 shares of D and buy 50 shares of B, then the allocation will change which could change the Net Asset Value. To reduce the complexity of this calculation, the NAV of a fund is calculated only when all markets are finished for the trading day. Also, in those days when markets are closed, ie when there is no trading, the mutual fund's NAV remains unchanged.