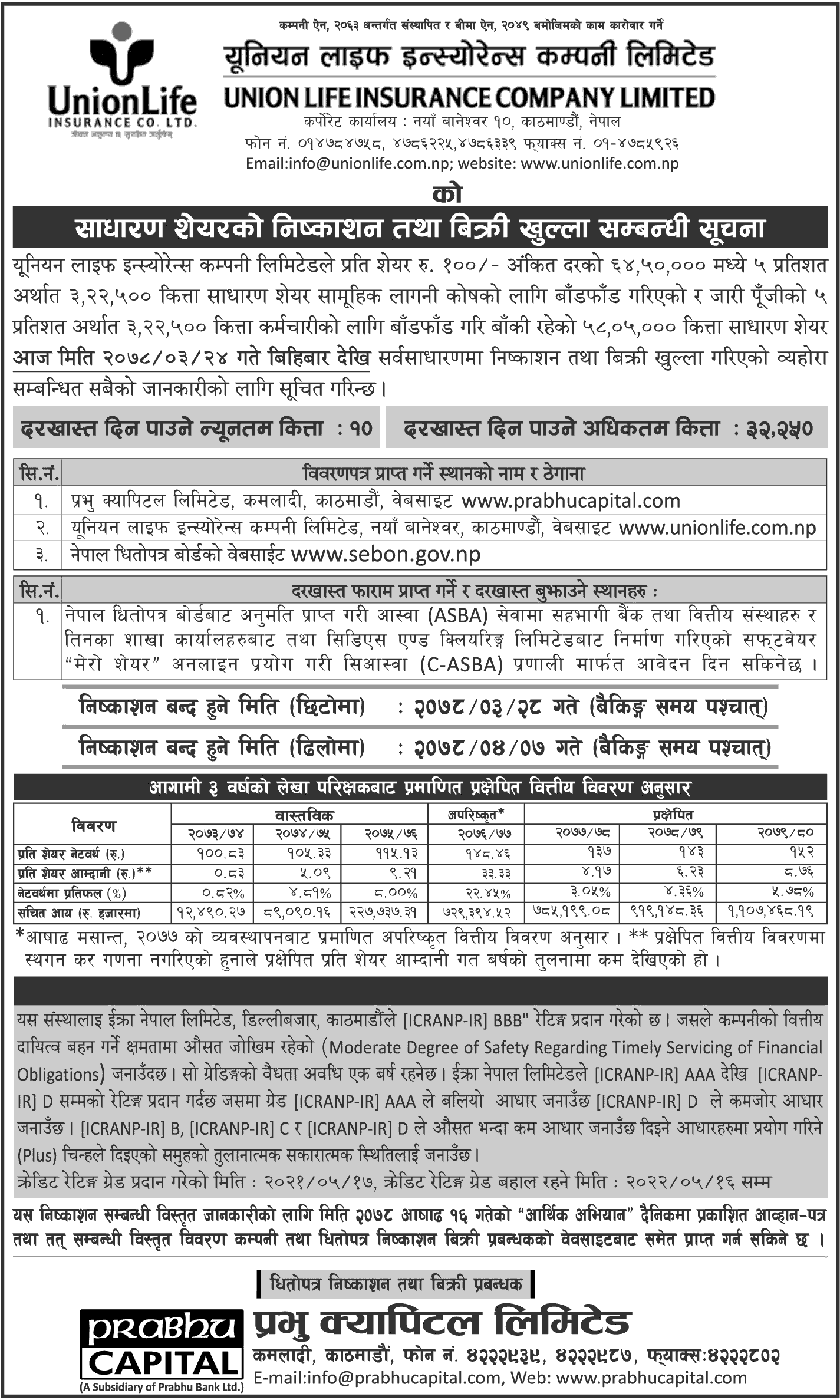

Union Life Insurance Company Limited has issued an initial public offering (IPO) to the public from 8th July 2021 to 12th July 2021. The company has issued 6.45 million shares equal to Rs 645 million, which is 30 percent of the total issued capital of Rs 2.15 billion.

Of that, 5 percent or 322,500 shares have been secured for employees and another 5 percent for collective investment funds and the remaining 58.5 million shares have been sold to the public.

In the IPO of Union Life Insurance, applications can be submitted as soon as possible till July 12 and if there are not enough applications within that period, applications can be submitted till July 20. At the rate of Rs. 100 per share, applications can be made for a minimum of 10 units and a maximum of 32,250 lots in multiples of 10 points.

C-ASWA members, licensed by the Securities and Exchange Board of Nepal (SEBON), can also apply for IPOs through banks and financial institutions and through Meroshare's web and app.

Prabhu Capital Limited is the IPO issuer and sales manager of Union Life Insurance. The guarantor is Nabil Investment Banking Limited.

At present, the company's paid-up capital is Rs 1.5 billion. After the IPO, the company's paid-up capital will reach Rs 2.15 billion.

Rating agency ICRA Nepal has given ICRP-IR Triple B rating to the IPO to be issued by Union Life Insurance. This indicates an average risk in the company's ability to bear responsibility.

About Company:

Union Life Insurance is a company established under the Companies Act 2063 BS and conducts life insurance business in accordance with the Insurance Act 2049 BS and Insurance Regulations 2049 BS.

It has been operating as per the Companies Act by obtaining business approval on 31st Ashoj 2074 BS and getting a life insurance business license from the Insurance Committee on 20th Ashad, 2074 BS and has been operating insurance business since 4th Ashoj, 2074 BS.

The registered office of the company is located in Siddharthnagar Municipality, Ward No. 8, Rupendehi. The main business office of the company is in Kathmandu Metropolitan City, Ward No. 10, New Baneshwor. At present, the company is providing services from 205 branch and sub-branch offices including seven provincial offices.

According to the decision of the first annual general meeting of Union Life Insurance, the public has to issue 645 thousand shares at the face value of Rs 100 per share equal to Rs 645 million.

The company has stated that the public has to issue IPO in order to raise the required capital for the activities to be done in accordance with the objectives mentioned in the management letter and rules of Union Life Insurance, to develop the services, and to increase the risk of the insurance business.

Union Life Insurance has stated that the capital raised by issuing IPO will be used for commercial purposes of the company subject to the Companies Act, Insurance Act, Rules, and other prevailing laws.

Out of the amount collected after the IPO, the company has Rs. 161.25 million in Government of Nepal bonds/development bonds, Rs. 258 million in term deposits of commercial banks, Rs. 96.7 million in term deposits of development banks and Rs. 64.5 million in term deposits of finance companies. The company has stated that it will invest Rs 64.5 million in rupees and shares of public companies.

Financial Position of the Company:

Union Life Insurance has projected to increase its accumulated income to Rs 1.107 billion by the fiscal year 2079/80. The accumulated income was Rs. 89 million in FY 2074/75 and Rs. 227.7 million in FY 2075/76.

As per the unaudited financial statements of the Fiscal Year 2076/77, the accumulated income is Rs. 729.3 million. Union Life Insurance has projected to increase its accumulated income to Rs. 785.1 million in the current Fiscal Year 2077/78 and Rs. 919.1 million in the Fiscal Year 2078/79.

Similarly, Union Life Insurance has a projected net worth of Rs 152 per share and earnings of Rs 8.76 per share by the fiscal year 2079/80. According to the unrevised financial statement of the last fiscal year, the net worth of the insurance company is Rs 148.46 per share and the earnings per share are Rs 33.33.

Net worth is projected at Rs 137 per share and earnings per share at Rs 4.17 in the current fiscal year.

Union Life Insurance has earned a total premium of Rs 5.70 billion as of mid-June of the current fiscal year. This is an increase of 56.16 percent over the same period last fiscal year. As of mid-June of the last fiscal year, the company had earned a total premium of Rs 3.65 billion.

IPO Date IPO