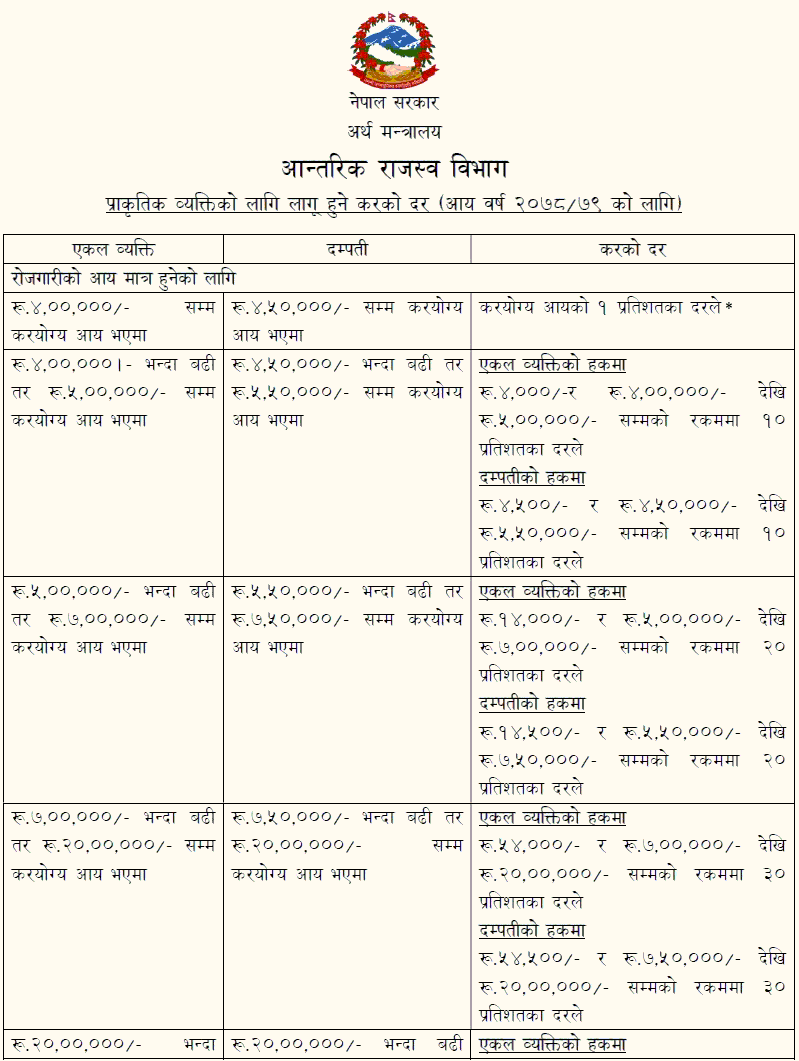

Government of Nepal, Ministry of Finance, Inland Revenue Department, the Tax rate applicable for natural persons (for the income year 2078/79): In the case of taxpayers registered as a sole proprietorship, one percent tax will not be levied on the income from retirement, pension fund, and natural person contributing to the contribution-based social security fund.

Subsections (1) and (2) of Section 1 of Schedule 1

Income Tax Rate In Nepal For Individual (Unmarried):

| Annual Income | Income Tax Rate (FY 2078/79) |

| Up to Rs 4,00,000 | 1% |

| Additional Rs 1,00,000 | 10% |

| Additional Rs 2,00,000 | 20% |

| Additional Rs 1,300,000 | 30% |

| Additional Tax Above Rs 2,000,000 | 36% |

Income Tax Rate In Nepal For Married Couple:

| Annual Income | Tax Rate In Nepal (FY 2078/79) |

| Up to Rs 450,000 | 1% |

| For Additional Rs 100,000 | 10% |

| For Additional Rs 200,000 | 20% |

| For Additional Rs 1,250,000 | 30% |

| Additional Tax Above Rs 2,000,000 | 36% |

Tax Rate In Nepal For Non-Residents:

| Source of Income | Tax Rate |

| Normal transactions | 25% |

| Through shipping, air or telecom services, postage, satellite, and optical fiber project | 5% |

| Shipping, air, or telecom services through the territory of Nepal | 2% |

| Repatriation of profit by Foreign Permanent Establishment | 5% |

Corporate Income Tax In Nepal:

| Type of Business | Normal Tax Rate | Rebate | Applicable Tax Rate |

| Normal Business | 25% | – | 25% |

| Special Industry under section 11 for the whole year | 25% | 20% | 20% |

| Constructing and operating ropeway, cable car, railway, tunnel or sky bridge | 25% | 40% | 15% |

| Constructing and operating roads, bridges, tunnel, railway, and airports | 25% | 50% | 12.50% |

| trolley bus or trams | 25% | 40% | 15.00% |

| Entities with export income from a source in Nepal | 25% | 20% | 20% |

| Banks and financial institutions (A, B & C Class) | 30% | – | 30% |

| General Insurance (Non-Life Insurance) | 30% | – | 30% |

| Tobacco, alcohol, cigarette and related products | 30% | – | 30% |

| Telecom and Internet Services | 30% | – | 30% |

| Capital market, Securities, Merchant banking, Commodity futures market, Securities & Commodity broker | 30% | – | 30% |

| Money transfer | 30% | – | 30% |

| Petroleum business under Nepal Petroleum Act, 2040 | 30% | – | 30% |

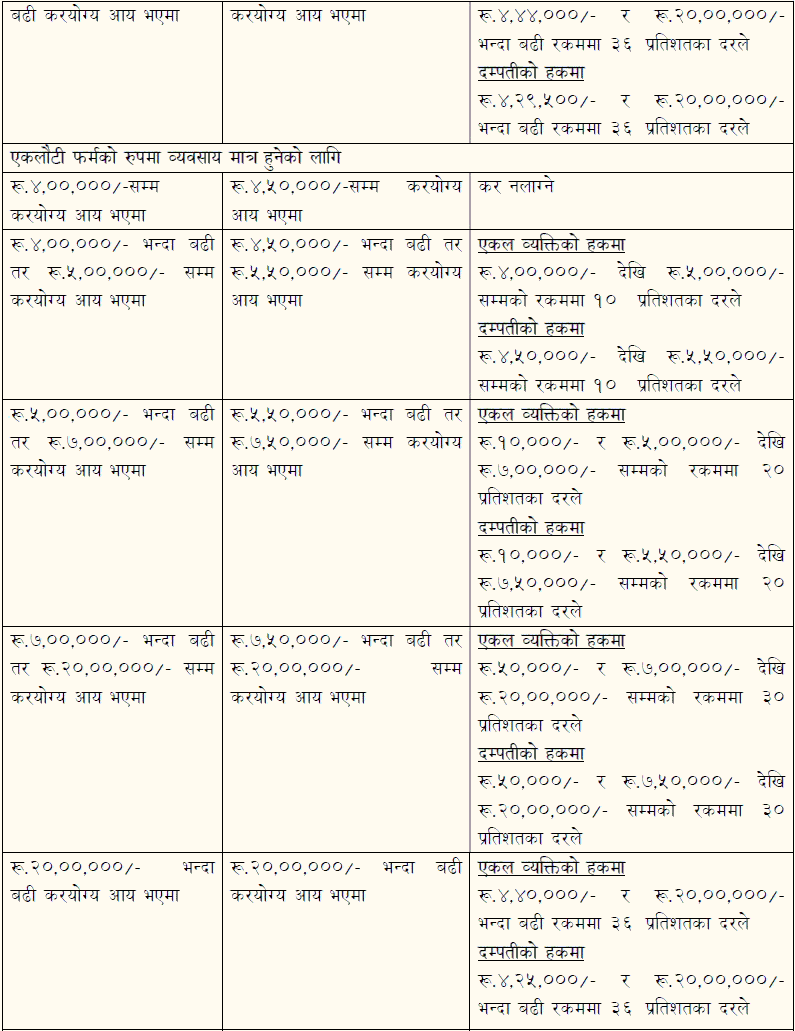

Amount not included in natural person's income or exemption in expenses:

1) Remote Allowance Facility:

Amount to be deducted from the taxable income of a natural person working in a remote area: -

- In the area of ââthe “A” category, Rs. 50,000 (fifty thousand)

- In the “B” class area, Rs. 40,000 (forty thousand)

- In the area of ââthe “C” category, Rs. 30,000 (thirty thousand)

- In the “D” class area, Rs. 20,000 (Twenty Thousand)

- In the “E” class area, Rs. 10,000 (Ten Thousand)

2) Exemption facility in foreign allowance:

Seventy-five percent of the foreign allowance received by the employees working in Nepal's diplomatic missions abroad can be deducted from the taxable income.

3) Exemption facility available to a person with retirement income:

If the resident is a natural person's retirement income, such person will be allowed to deduct twenty-five percent from the taxable income limit.

4) Exemption facility for persons with disabilities:

If the resident is a natural person with a disability, such person will be allowed to deduct an additional fifty percent from the taxable income limit.

5) Investment insurance exemption facility:

If the resident natural person has insured the investment, the amount deducted from the annual premium of Rs. 25,000 paid for such insurance can be deducted from the taxable income.

6) Premium paid for health insurance:

If the resident natural person has health insurance with the resident insurance company, the amount deducted from the annual premium paid for such insurance or Rs. 20,000 can be deducted from the taxable income.

7) Premium paid for insurance of private building owned by you:

If the resident natural person has insured the private building owned by the resident insurance company, the annual premium paid for such insurance or the amount which is less than five thousand rupees can be deducted from the taxable income.

8) Tax exemption for women with only wage income

If a resident is a natural person earning only wage income, then the exemption will be ten percent of the tax amount to be paid by such a natural person.

Presumptive Tax: D-01 For submitting income statement:

The taxable income received by the resident natural person from the business will be Rs. 300,000 and the business turnover will not be more than Rs. 3 million annually. Subsection (4) of Section 4 of the Income Tax Act 2018

| Areas of business | Tax amount Rs. |

| Natural persons doing business in metropolitan or sub-metropolitan areas | 7,500 |

| Natural persons doing business in the municipal area | 4,000 |

| Natural persons doing business in areas other than those mentioned above | 2,500 |

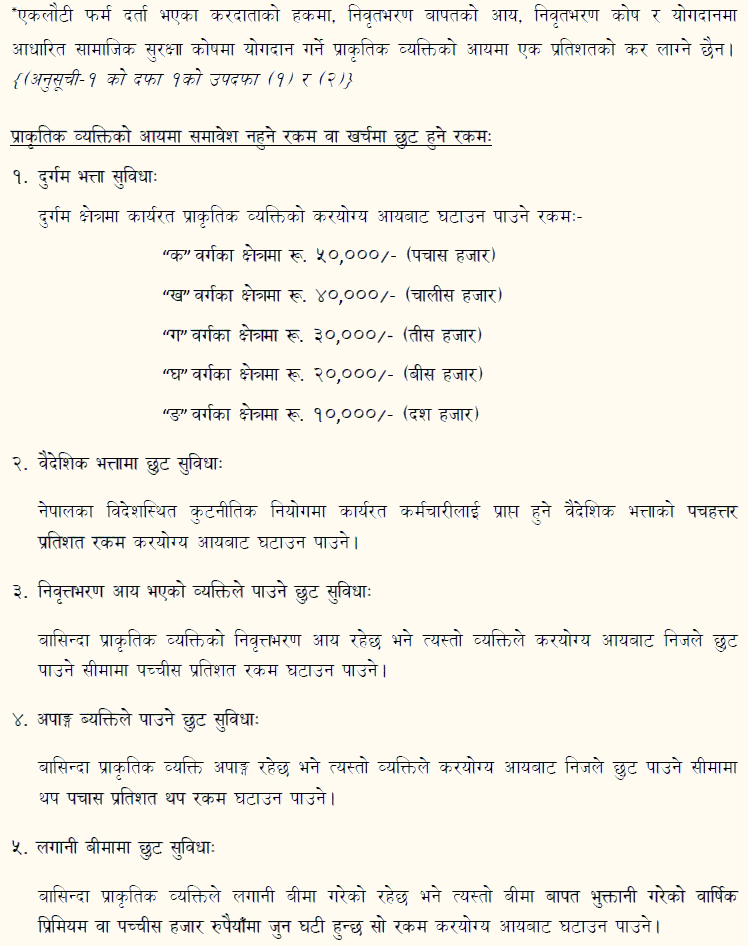

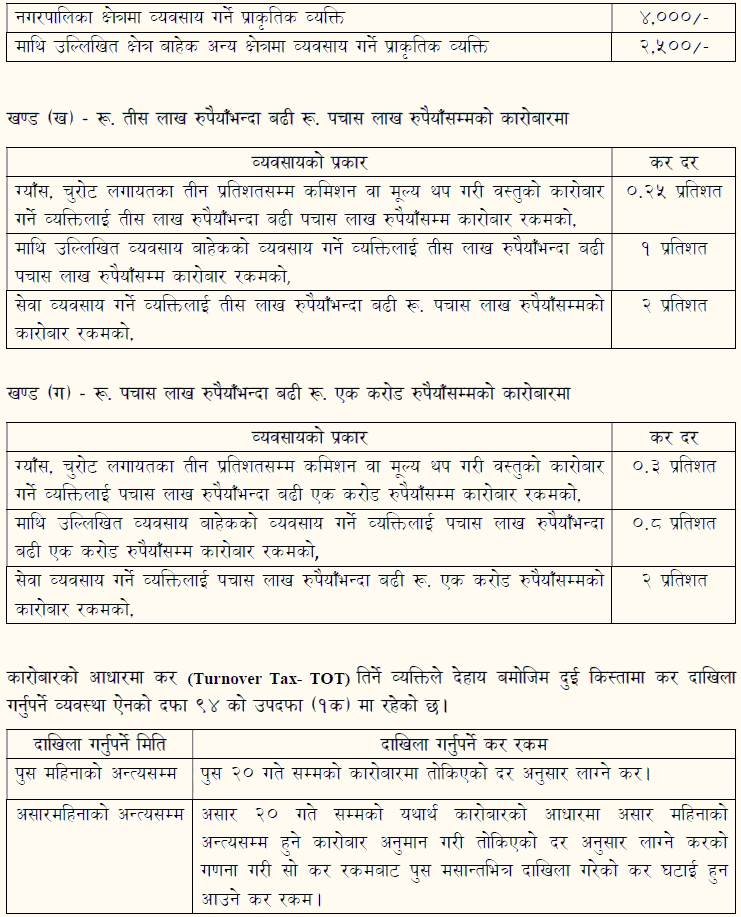

Taxes based on transactions (1 Pa 1049. '195): 1) -02 For submitting income statement:

In the case of taxpayers who have only income from business with natural resources in Nepal, taxable income from the business is less than Rs. 1 million and business turnover is more than Rs. 3 million less than Rs. (A) and (b) Ba (a), (b), and (c) should be filed as per the sum. Income Tax Act; Sub-section (a) of section 4 of section 2048 (a)

In transactions up to three million rupees:

| Areas of business | Tax amount Rs. |

| Natural persons doing business in metropolitan or sub-metropolitan areas | 7,500 |

| Natural persons doing business in the municipal area | 4,000 |

| Natural persons doing business in areas other than those mentioned above | 2,500 |

Clause (b) - In transactions above Rs. 3 million to Rs. 5 million

| Business Type | Tax Rate |

| Up to three percent commission on Gas, cigarettes, etc., or value-added to a person who trades goods up to three million rupees up to five million rupees of transaction amount: 0.25 percent. | 0.25% |

| To a person doing business other than the above-mentioned business, more than Rs. 3 million to Rs. 5 million of the transaction amount | 1% |

| A person doing service business for a transaction amount of more than Rs. 3 million to Rs. 5 million | 2% |

Section (c) - In transactions of more than Rs. 50 lakhs to Rs. 10 million

| Business Type | Tax Rate |

| Up to three percent commission on Gas, cigarettes, etc. or value added to a person who trades goods up to more than five million rupees to ten million rupees of the transaction amount | 0.30% |

| To a person doing business other than the above-mentioned business up to Rs. 5 million up to Rs. 10 million of the transaction amount | 1% |

| A person doing service business with a turnover of more than Rs. 5 million to Rs. 10 million | 2% |

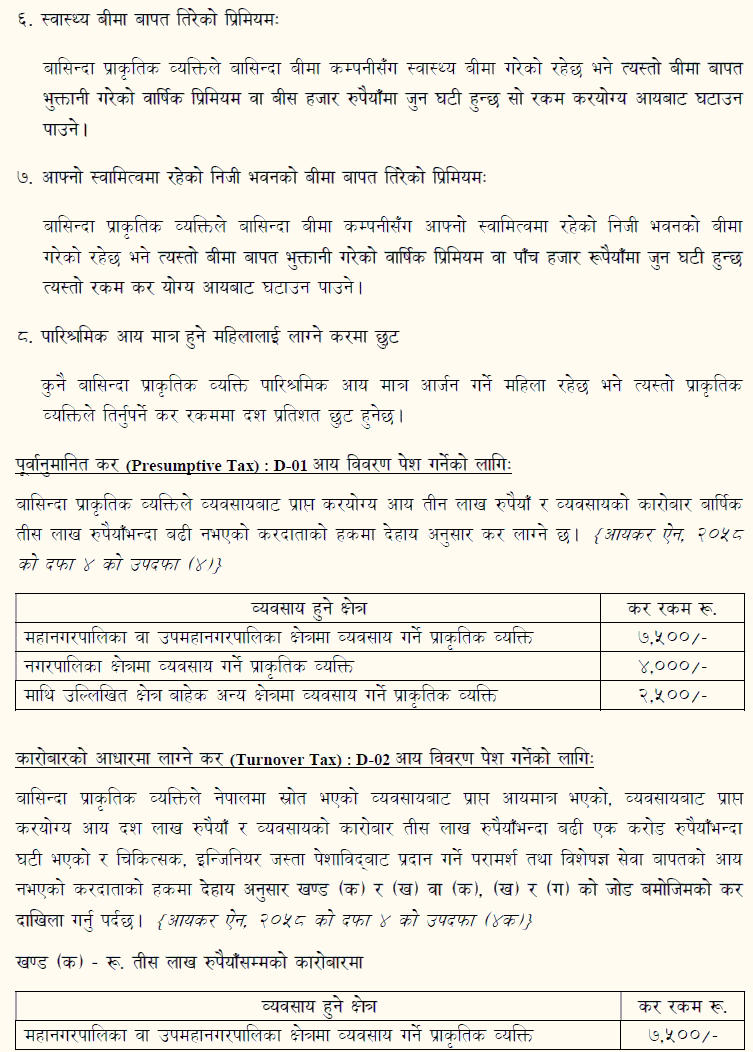

Sub-section (1a) of Section 94 of the Act provides that a person who pays Turnover Tax (TOT) on the basis of turnover has to file tax in two installments as follows.

| Date to be filed | Tax amount to be filed |

| Until the end of the month of Poush | Tax to be levied on transactions as per the prescribed rate till Poush 20 |

| Until the end of the month of Ashad | Based on the actual turnover till Ashad 20, the turnover till the end of Ashad is estimated and the tax levied at the prescribed rate is calculated and the tax amount filed by Poush end is deducted from that tax amount. |