Overview

Rastriya Beema Company Limited (RBCL) (Words in Nepali: राष्ट्रिय बिमा कम्पनी लिमिटेड) was established in 2014 AD as a government-owned public limited company formed under the decision of the Government of Nepal, to separate the general insurance business of the Rastriya Beema Sansthan (RBS) by mobilizing internal resources of Nepal.

Consequently, as on this date, the company has been successfully providing returns as per the set goals and objectives of the Nepal Government in this tenure, and today's company is contributing revenue without inflicting any additional liability on the government. The company has expanded its workforce in the insurance sector & has established itself as a credible player in the insurance sector. The company is established with the following capital structure.

Rastriya Beema Sansthan (Pvt. Ltd.) was established on Poush 1, 2024 B.S., with investment from the Government of Nepal to initiate the insurance sector in the country, contribute to national capital formation, and reduce foreign currency expenditure. It started its non-life insurance business on Falgun 11 of the same year.

After the implementation of the Rastriya Beema Sansthan Act in 2025 B.S., it became Rastriya Beema Sansthan and continued operating. As per Section 12 of the Insurance Act, 2049 B.S., stating that insurers operating life and non-life insurance businesses must separate into different entities from the date specified by the Board, the company was registered under the Companies Act, 2063, on Jestha 28, 2071 B.S. at the Office of the Company Registrar.

It received a license for non-life insurance from the Insurance Board on Asar 27 and began its non-life insurance operations from Shrawan 18.

Having completed 11 years of operation, the company has now entered its 12th year.

Sole Government-Owned Non-Life Insurance Company

Rastriya Beema Company Limited is the only non-life insurance company in Nepal fully owned by the Government of Nepal. Intending to mobilize internal resources and manage financial risks through insurance services, the company has been providing various insurance services for the past 58 years to different ministries of the Government of Nepal and their subordinate agencies, constitutional bodies, public institutions, private businesses, and the general public.

As a result, the company has played a leading role in the development and expansion of Nepal’s insurance market. With trust and support from the government, private sector institutions, and the general public, the company has successfully grown its business despite intense market competition, thanks to its professional, customer-oriented practices and high-standard services tailored to changing market needs.

Supporting Government Policy and Expansion

Following the policy set in the fiscal budget of 2052/53, the company has been contributing to national priorities such as:

-

Expanding the scope of property insurance to include losses from natural disasters, calamities, and accidents

-

Enhancing access to insurance at the rural level

-

Introducing cyber insurance services

The company has brought national pride projects, government and private assets, industries, and commercial businesses under the insurance framework.

RBCL also offers financial protection through insurance in areas prone to losses, such as:

-

Physical infrastructure development

-

Government and private property

-

Agriculture and livestock

-

Public health

Company Profile:

Inception:

The inception of Business: The company was registered with the Company register on 11th June 2014 (28th Jestha 2071) and has obtained a certificate of Commencing general insurance business from the name of the company on 3rd August 2014(18th Shrawan 2071).

Objectives:

- To mobilize internal resources and capital for national development and to check the burden of expenses of foreign currency.

- To Minimize the risk of property damage through the insurance business

Major Functions and Duties of Rastriya Beema Company Limited:

-

To run the business of Nonlife insurance

-

To conduct and cause to conduct reinsurance

-

To invest within the state in areas deemed by it to be appropriate and to take necessary steps of recovery and safety of such investment

-

If demanded to be appropriate to control any property kept by it as mortgage and manage such property by itself till the required period of time

-

To provide a loan in the guarantee of movable or immovable property

-

To raise loan by mortgaging its property deemed to be appropriate for such propose

-

To rent out any of its property, to sell or dispose of it in any other manner

-

To assist issuance of shares and debentures of other agencies, to provide a guarantee for such, to underwrite and to run agency business

-

To invest abroad if deemed to be appropriate

-

To invest in the share capital of other corporate entities

-

To appoint agents and provide for their commission

-

To provide guarantee

-

To purchased share, bond, debenture, letter of credit, movable and immovable property to give and take discount and commission to conduct brokerage services

-

To run any types of business benefits for the corporation

-

To work for the direct and indirect benefit and welfare of any national charity, public welfare associations or corporations or to provide surety for such

-

To manage the fund for the gratuity, provident fund, pension, and other benefits for its permanent personal

-

To issue debentures and preference shares

Priority on Financial Audits

The company has prioritized long-pending audits. As a result:

-

The audit up to FY 2076/77 has been completed

-

The third Annual General Meeting was held on 2072/03/29

-

The audit for FY 2077/78 is being completed, with a target to hold the AGM within the first quarter of the current fiscal year

-

Remaining audits are in progress

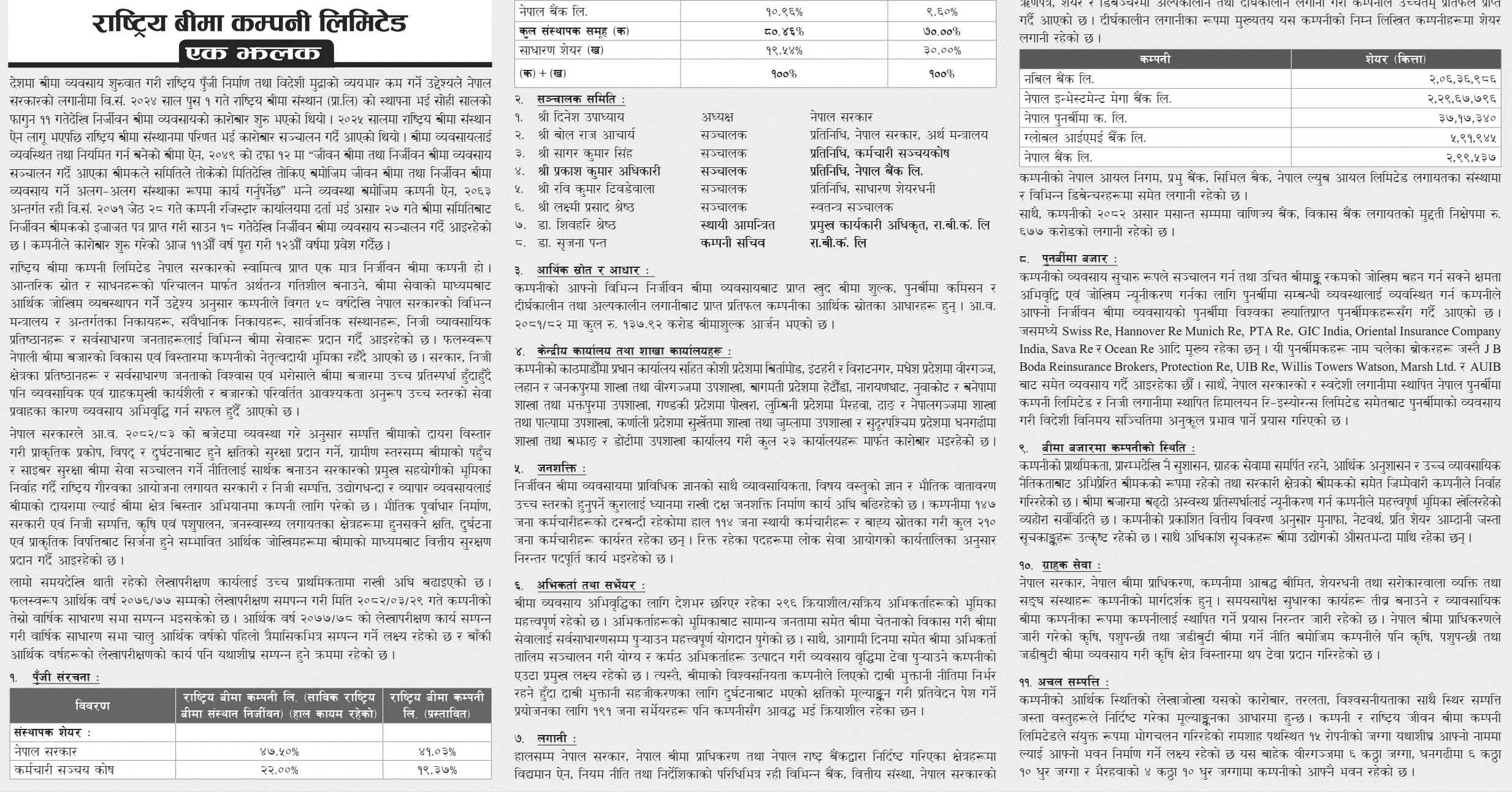

1. Capital Structure

-

Rastriya Beema Company Ltd. (former non-life division): 47.50%

-

Founder Shares:

-

Government of Nepal

-

Employees Provident Fund: 22.00%

-

-

Rastriya Beema Company Ltd. (Proposed):

-

41.03%, 19.37%

-

-

Nepal Bank Ltd.: 10.96%, 9.60%

-

Total Promoter Group (A): 80.46%

-

Ordinary Shares (B): 19.54%

-

(A) + (B): 100%

Company Shareholding

-

Rastriya Beema Company Ltd. (Existing): 20,636,986 shares

-

Proposed RBCL: 22,967,796 shares

-

Employees Provident Fund: 3,717,340 shares

-

Nepal Bank Ltd.: 591,945 shares

-

Public: 299,537 shares

The company has been achieving high returns through short and long-term investments in shares and bonds. It holds equity in the following companies:

-

Nabil Bank Ltd.

-

Nepal Investment Mega Bank Ltd.

-

Nepal Reinsurance Company Ltd.

-

Global IME Bank Ltd.

2. Board of Directors

-

Chairperson, Government of Nepal

-

Director, Ministry of Finance (MoF) Representative

-

Director, Employees Provident Fund Representative

-

Director, Nepal Bank Ltd. Representative

-

Director

-

Independent Director

-

Permanent Invitee, Company Secretary

-

Public Shareholders’ Representative

-

Chief Executive Officer: Rastriya Beema Company Ltd.

3. Financial Sources and Base

RBCL's financial base includes:

-

Net premium income from non-life insurance

-

Reinsurance commissions

-

Returns from long- and short-term investments

4. Central and Branch Offices

RBCL operates through 23 offices across Nepal:

-

Central Office: Kathmandu

-

Koshi Province: Birtamod, Itahari, Biratnagar

-

Madhesh Province: Birgunj, Lahan, Janakpur (+ Birgunj sub-branch)

-

Bagmati Province: Hetauda, Narayanghat, Nuwakot, Banepa (+ Bhaktapur sub-branch)

-

Gandaki Province: Pokhara

-

Lumbini Province: Bhairahawa, Dang, Nepalgunj (+ Palpa sub-branch)

-

Karnali Province: Surkhet (+ Jumla sub-branch)

-

Sudurpashchim Province: Dhangadhi (+ Bajhang, Doti sub-branches)

5. Workforce

RBCL requires high-level technical and professional expertise in non-life insurance. The company is advancing workforce development accordingly.

-

Approved Staff Positions: 147

-

Current Staff:

-

Permanent: 114

-

Contract/Outsourced: Total 210

-

Vacancies are being filled as per the Public Service Commission schedule.

6. Agents and Surveyors

-

Active Agents Nationwide: 296

-

These agents play a crucial role in raising insurance awareness and reaching the general public.

RBCL aims to conduct agent training and produce skilled, dedicated agents to support business growth.

-

Surveyors: 191 are affiliated with RBCL to evaluate losses and support claims settlement.

7. Investments

RBCL’s investments comply with the regulations of:

-

Government of Nepal

-

Insurance Board of Nepal

-

Nepal Rastra Bank

Investments are held in:

-

Nepal Oil Corporation

-

Prabhu Bank

-

Civil Bank

-

Nepal Lube Oil Limited

-

Debentures and term deposits

As of the end of Ashadh 2082, NPR 6.77 billion is invested in fixed deposits with commercial and development banks.

8. Reinsurance Market

RBCL partners with global reinsurers for risk management and business continuity:

-

Key Reinsurers:

-

Swiss Re

-

Hannover Re

-

Munich Re

-

PTA Re

-

GIC India

-

Oriental Insurance (India)

-

Sava Re

-

Ocean Re

-

Reinsurance Brokers:

-

J B Boda

-

Protection Re

-

UIB Re

-

Willis Towers Watson

-

Marsh Ltd.

-

AUIB

Domestic Partners:

-

Nepal Reinsurance Company Ltd.

-

Himalayan Reinsurance Ltd.

These efforts support foreign exchange retention.

9. Market Position

RBCL maintains:

-

Strong governance

-

Customer-centric service

-

Financial discipline

-

High professional ethics

It has helped counter unhealthy market competition.

Key Performance Indicators: Profit, net worth, EPS—all surpass industry averages.

10. Customer Service

RBCL follows guidance from:

-

Government of Nepal

-

Insurance Board

-

Policyholders

-

Shareholders and stakeholders

Ongoing improvements aim to establish RBCL as a professional insurer.

Agricultural Coverage: In line with Insurance Board policy, RBCL offers agriculture, livestock, and herbal insurance to support sector expansion.

11. Real Estate Holdings

Company value is determined by liquidity, reliability, and fixed assets.

RBCL and National Life Insurance Co. Ltd. jointly manage a 15-ropani plot at Ramshah Path. Plans are in place to transfer ownership to RBCL and construct its headquarters.

Other Properties:

-

Birgunj: 6 Kattha

-

Dhangadhi: 6 Kattha 10 Dhur

-

Bhairahawa: 4 Kattha 10 Dhur

All have company-owned buildings.

You need to login to comment.