Sanima Middle Tamor Hydropower Limited IPO for General Public from Falgun 26, 2079

Sanima Middle Tamor Hydropower Limited is issuing IPO from 10th March 2023 (Falgun 26, 2079). The company has already allocated 15 percent of the issued capital of 3 billion 332 million rupees, i.e. 49 million 98 million 75 thousand rupees, to issue 49 million 98 thousand 750 ordinary shares to the general public. If you are interested in investing in this IPO, here is a complete guide for you.

An initial public offering (IPO) is a process where a company offers its shares to the public for the first time. This allows the company to raise capital by selling a portion of its ownership to public investors. In return, the investors become shareholders and can participate in the growth and profitability of the company.

In Sanima Middle Tamor Hydropower Limited IPO, the company is issuing ordinary shares to the public. There are two types of shares: short-tailed and long-tailed.

Short-tailed shares are shares with a short-term investment horizon, usually less than one year. They are often traded frequently and have a high level of liquidity. Long-tailed shares, on the other hand, have a long-term investment horizon, usually more than one year. They are often held for a longer period and have a lower level of liquidity.

Before investing in any IPO, it is important to determine your investment horizon. The investment horizon is the period of time you plan to hold the shares. Short-tailed shares are suitable for investors with a short-term investment horizon, while long-tailed shares are suitable for investors with a long-term investment horizon.

Minimum and Maximum Investment

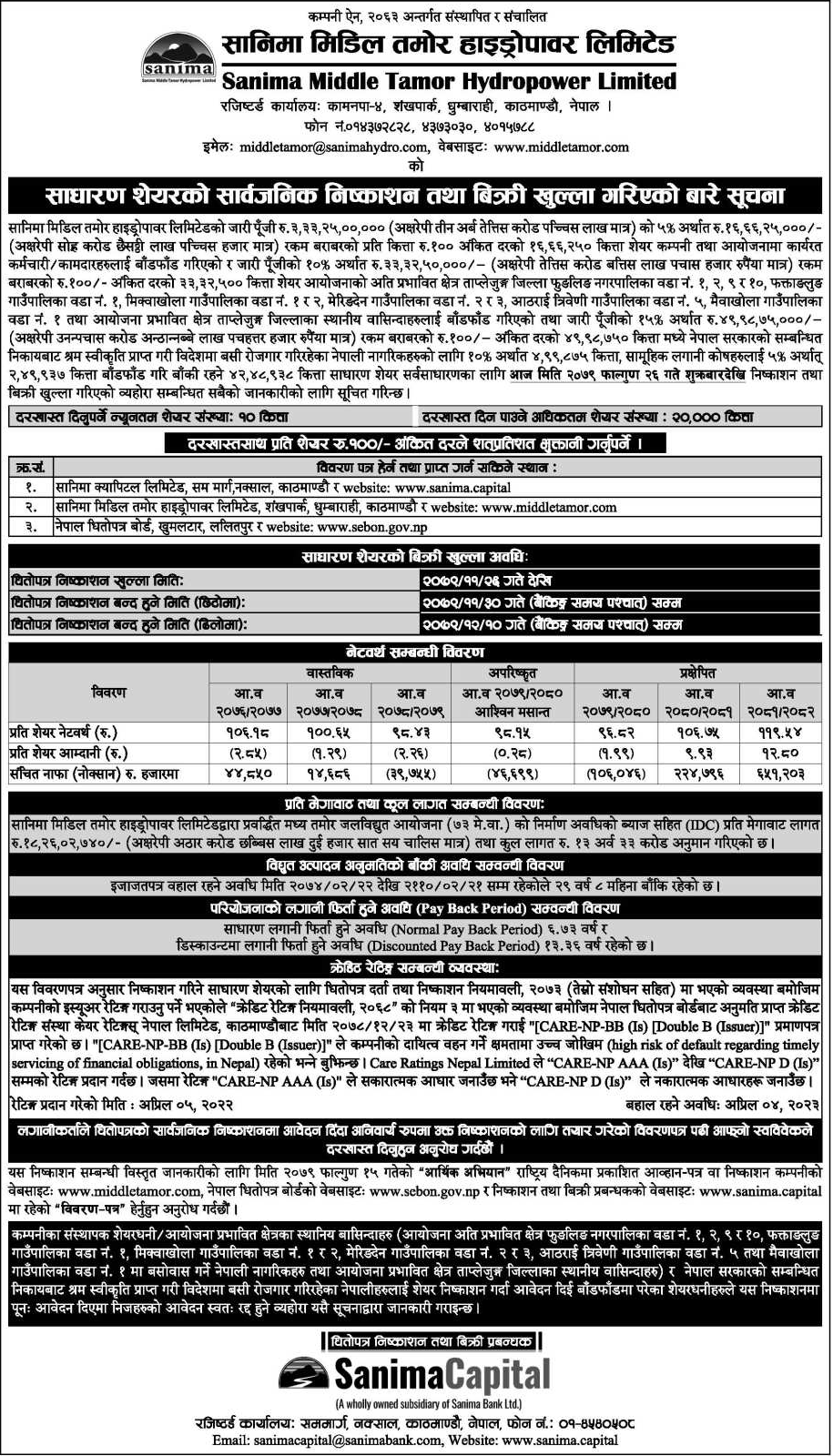

In Sanima Middle Tamor Hydropower Limited IPO, you can apply for those shares from a minimum of 10 shares to a maximum of 20,000 shares. It is important to note that the number of shares you apply for does not guarantee that you will receive all of them.

Cost and Payback Period

The total cost of the 73 MW Madhya Tamor hydropower project being operated by the company is estimated at 13 billion 33 billion rupees. The cost per megawatt of the project is estimated at Rs 182.6 million 2740. The normal investment payback period of the project is 6.73 years while the discount payback period is 13.36 years.

Risk Assessment

Care Rating Nepal has given Care NP Double B Issuer Rating to the company in the rating given for the IPO issue. This indicates a high risk to the company's ability to meet its obligations. Investors should carefully consider this risk before investing in the IPO.

Closing of Issue

The close of issue will be on the 30th of Falgun at the earliest and on the 10th of Chaitra at the latest. Investors should apply before the closing date to ensure they have a chance to receive shares.

How to Apply

Sanima Capital Limited is the company's share issue and sales manager. Investors can apply from all C-ASBA member banks and financial institutions and their designated branch offices that have received approval from the Nepal Securities Board (SEBON).

IPO Details

Investing in an IPO can be a profitable opportunity for investors, but it also involves risk. It is important to do your own research and analysis before investing. Sanima Middle Tamor Hydropower Limited is issuing IPO from 10th March 2023, and investors can apply for those shares from a minimum of 10 shares to a maximum of 20,000 shares. Keep in mind the risk factors, cost, and payback period before investing in this IPO.

One of the key risk factors to consider when investing in any IPO is the company's financial health and stability. In the case of Sanima Middle Tamor Hydropower Limited, the Care NP Double B Issuer Rating given by Care Rating Nepal indicates a high risk to the company's ability to meet its obligations. This means that investors should be cautious and carefully consider their investment decision.

It is also important to consider the cost and payback period of the project. The total cost of the Madhya Tamor hydropower project being operated by the company is estimated at 13 billion 33 billion rupees, with a cost per megawatt of Rs 182.6 million 2740. The investment payback period of the project is 6.73 years while the discount payback period is 13.36 years. These figures should be taken into account when assessing the potential returns on investment.

Another factor to consider is the regulatory environment in which the company operates. Sanima Middle Tamor Hydropower Limited has a power generation permit with 29 years and 8 months remaining. However, changes in government policies, regulations, or economic conditions can affect the company's operations and financial performance.

Investors should also be aware of the minimum and maximum number of shares they can apply for and the close of issue date, which is on the 30th of Falgun at the earliest and on the 10th of Chaitra at the latest. They should also ensure that they apply through a C-ASBA member bank or financial institution that has received approval from the Nepal Securities Board (SEBON).

Overall, while investing in an IPO can be a lucrative opportunity, it also involves significant risks. It is crucial to conduct thorough research and analysis of the company, its financial health and stability, regulatory environment, and other factors before making any investment decision. Potential investors in Sanima Middle Tamor Hydropower Limited's IPO should carefully consider the risk factors, cost, payback period, and other relevant information before deciding whether to invest.

Company Profile: Sanima Middle Tamor Hydropower Ltd.

Sanima Middle Tamor Hydropower Ltd. is a Nepal-based company that is primarily engaged in the generation and sale of hydroelectric power. The company is currently developing a 73 MW Middle Tamor Hydropower Project, a run-of-river project located in Phungling Municipality, Phaktalung and Mikwa Khola Rural Municipalities in Taplejung District.

The Generation License for the project was initially obtained for 54 MW on Jestha 22, 2074 BS (June 5, 2017), and subsequently, the design was revised and a generation license for the revised capacity of 73 MW was obtained on Mangsir 24, 2075 BS (December 10, 2018). The company has already signed the Power Purchase Agreement (PPA) with Nepal Electricity Authority (NEA) on Poush 16, 2073 BS (Jan 10, 2017) for the 54 MW and Mangsir 14, 2075 BS (Nov 30, 2018) for the additional capacity.

The Middle Tamor Hydropower Project is expected to generate 429.17 GWh of electricity annually, which will be supplied to the national grid, helping to meet the country's growing demand for energy. The total estimated cost of the project is Rs 12.68 Arba, out of which Rs 3.33 Arba will be funded through equity and the remaining Rs 9.35 Arba will be funded through debt. Nepal Investment Bank will lead the co-financing for the project along with Nabil Bank, Global IME Bank, NMB Bank, NCC Bank, Laxmi Bank, Nepal SBI Bank, and ADBL Bank.

Sanima Middle Tamor Hydropower Ltd. is committed to utilizing Nepal's rich water resources to produce clean and sustainable energy for the country. The company aims to contribute to Nepal's economic development and provide reliable and affordable electricity to its customers. The company has a strong team of professionals with extensive experience in the hydropower industry and is committed to delivering the Middle Tamor Hydropower Project on time and within budget.

Overall, Sanima Middle Tamor Hydropower Ltd. is a promising company in the Nepalese energy sector, with a strong focus on sustainable energy production and economic development. The company's commitment to quality, safety, and the environment, combined with its experienced team and strong financial backing, make it a reliable and trustworthy partner in Nepal's quest for energy self-sufficiency.