Overview

BBS at BST College, Gongabu, Kathmandu

Bachelor of Business Studies (BBS) at BST College, Gongabu, Kathmandu, is a four-year Tribhuvan University (TU) program that prepares you for entry-level roles in accounting, finance, marketing, and management.

The college runs the BBS program under TU’s Faculty of Management framework and admits eligible +2/10+2 graduates under TU rules. Facilities such as a library, computer lab, and auditorium support classroom learning, while the BBS fourth-year project and research components reinforce practical exposure.

Highlights

-

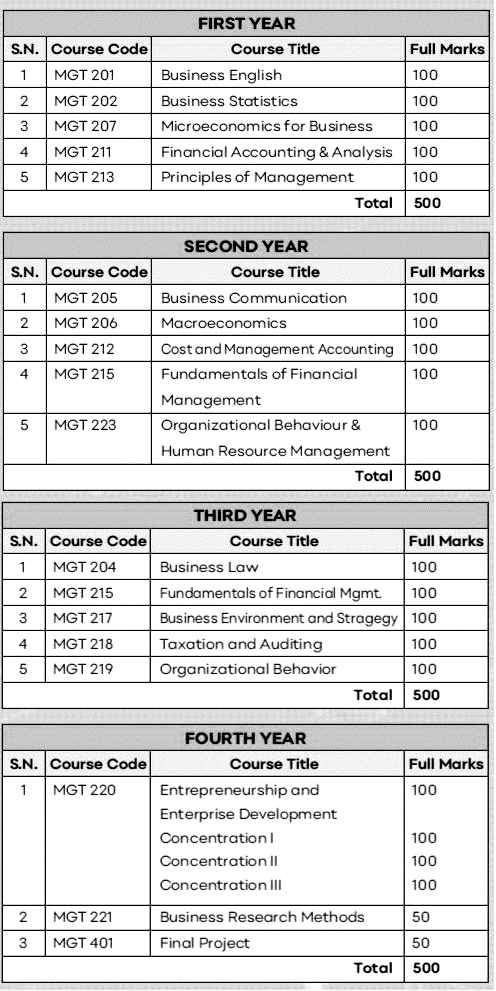

TU-affiliated BBS with annual exam system across four years; total 19 courses (1,950 marks) plus a final project (50 marks).

-

Structured progression from foundations to functional courses, three concentration papers, entrepreneurship (MGT 220), research methods (MGT 221), and a capstone project (MGT 401).

-

Campus resources include science and computer labs, hotel management lab (useful for service-sector case work), library, auditorium, transport, and games/sports.

-

College-level scholarships linked to GPA; additional merit support for entrance toppers and needy students.

-

Methods encouraged by TU: lectures, group discussions, problem-solving, guest talks, practical work, case analysis, and a field-based final project.

Curriculum Details

TU’s BBS curriculum combines foundations, core business courses, a concentration stream, entrepreneurship, research methods, and a final project. At BST College, the course codes and mark weights follow TU’s official structure.

Year-1 (500 marks)

-

MGT 201: Business English — 100

-

MGT 202: Business Statistics — 100

-

MGT 203/207: Microeconomics (TU lists MGT 203; the campus document lists MGT 207) — 100

-

MGT 211: Accounting for Financial Analysis — 100

-

MGT 213: Principles of Management — 100

TU’s master curriculum lists MGT 203; the BST booklet lists MGT 207. Students should confirm the current microeconomics code at admission.

Year-2 (500 marks)

-

MGT 205: Business Communication — 100

-

MGT 206: Macroeconomics — 100

-

MGT 212: Cost and Management Accounting — 100

-

MGT 214: Fundamentals of Marketing — 100

-

MGT 216 or MGT 223 (see note): TU lists Foundations of HRM (MGT 216); the BST booklet lists Organizational Behaviour & HRM (MGT 223). Confirm the mapping during registration.

Year-3 (500 marks)

-

MGT 204: Business Law — 100

-

MGT 215: Fundamentals of Financial Management — 100

-

MGT 217: Business Environment and Strategy — 100

-

MGT 218: Taxation and Auditing — 100

-

MGT 219: Organizational Behavior — 100

Year-4 (500 marks)

-

MGT 220: Entrepreneurship and Enterprise Development — 100

-

Concentration I — 100

-

Concentration II — 100

-

Concentration III — 100

-

MGT 221: Business Research Methods — 50

-

MGT 401: Final Project — 50

Concentration Areas (choose one stream; three papers)

Accounting, Finance, Management, or Marketing. TU provides specific course codes for each stream (e.g., ACC 250-254; FIN 250-254; MGT 250-254; MKT 250-254). The college confirms the semester-wise offering during academic planning each year.

Objectives

-

Build a solid base in language, economics, law, and quantitative methods.

-

Develop functional understanding of accounting, finance, marketing, and HR.

-

Encourage entrepreneurial thinking and the ability to start or improve small enterprises in Nepal.

-

Prepare students for higher studies, teaching, and entry-level roles in business and public organizations.

Scope

Graduates enter roles such as accounts assistant, junior analyst, sales executive, HR assistant, banking trainee, and operations support across SMEs, trading firms, cooperatives, hotels, travel businesses, NGOs/INGOs, and local government offices. The concentration area signals your preferred pathway; for instance, Accounting aligns with entry-level accounting support, while Marketing aligns with sales and communication roles. The TU project requirement and research methods unit strengthen your evidence-based work skills for these settings.

Learning Outcomes

By the end of BBS at BST College, students typically:

-

Prepare basic financial statements and interpret results against tax and auditing norms.

-

Apply micro/macro concepts to business problems and policy discussions.

-

Use marketing and HR concepts to address sales, retention, or staffing issues.

-

Conduct small research projects: define a problem, review literature, collect data ethically, analyze, and report.

-

Present findings clearly through reports and viva-voce, meeting TU’s project standards.

Skill Development Modules

-

Accounting and Tax Basics: MGT 211, MGT 218 provide bookkeeping, analysis, and awareness of Nepal tax and audit practice.

-

Finance Fundamentals: MGT 215 covers time value of money, capital budgeting, and working capital.

-

Marketing and Customer Focus: MGT 214 addresses product, price, place, and promotion, useful for retail and service sectors.

-

People and Organizations: MGT 219 (and TU’s HRM course in Year-2) frame motivation, behavior, and HR processes.

-

Entrepreneurship: MGT 220 strengthens venture planning in the Nepali context.

-

Research Practice: MGT 221 trains you to plan a study, collect data, and write a report that meets TU expectations.

Teaching Methodology

TU encourages a mix of lectures, group discussions, problem-solving, guest sessions, practicals, case work, and a mandatory field-based final project. BST College supports these methods with its auditorium for talks, a library for reading and referencing, and ICT/computer facilities for analysis and report writing. Students complete a four-week field study in the final year and submit a project for evaluation by internal and external examiners under TU rules.

Admission Requirements

TU eligibility (BBS):

-

Completion of 10+2 or equivalent from a recognized board.

-

English studied as a full paper.

-

Minimum marks as prescribed by TU/Faculty Board; many TU notices interpret this as second division (≥45%) or CGPA ≥1.8; campuses may specify additional criteria.

BST College information:

-

BBS is run under TU affiliation at BST.

-

Admissions open after SEE/+2 publication; forms and instructions are issued from the information desk; applicants submit the form with required documents and sit for the entrance process as notified.

Tip for applicants: bring SEE/+2 mark sheets, character certificate, migration (if applicable), two passport photos, and copies of citizenship or identity documents as per the college notice.

Career Opportunities

-

Accounting & Finance: accounts assistant, junior auditor support, billing, and bank trainee roles.

-

Marketing & Sales: sales executive, digital marketing support, customer relations.

-

HR & Administration: HR assistant, office coordinator, payroll support.

-

Entrepreneurship & Family Business: small venture planning, retail operations, services.

-

Public Sector & NGOs: project admin, field coordination, data entry, and finance support.

Graduates aiming for advanced roles often pursue MBS/MBA or short professional courses after BBS.

Scholarships and Financial Aid

BST College offers internal fee waivers based on GPA—ranging from partial to full waiver of admission, annual, and tuition fees. Examples include:

-

GPA 3.9–4.0: Admission, annual, and tuition fee fully waived.

-

GPA 3.6–3.8: Admission 100%, annual 50%, tuition 50% waived.

-

GPA 3.0–3.2: Admission 40%, annual 30%, tuition 20% waived.

Additional provisions include full scholarship for the college’s entrance topper and support for needy and deserving students. Check the latest notice each intake.

Why Choose This Course?

-

TU’s nationally recognized BBS structure with clear learning pathways and a compulsory project.

-

Location in northern Kathmandu for students from Gongabu and nearby areas.

-

Access to a library, computer lab, auditorium, and other facilities that aid presentations, research, and project work.

-

College-level scholarships that ease entry for high performers and support for those with need.

Conclusion

BBS at BST College follows TU’s framework and offers a steady path for learners who want practical business knowledge, a clear exam structure, and a final project grounded in local organizational reality. The curriculum covers accounting, finance, marketing, HR, entrepreneurship, and research—giving you a balanced entry point for work or further study. Campus facilities and scholarships add practical support during the four years.

FAQ

1) Is BBS at BST College under Tribhuvan University?

Yes. The BBS program at BST runs under TU’s Faculty of Management curriculum and codes.

2) What is the total structure and passing requirement?

BBS has 19 courses (1,950 marks) plus a 50-mark final project; students must pass theory/practical/project components separately under TU rules.

3) Which concentrations are available?

Accounting, Finance, Management, and Marketing; you select three papers in your chosen stream in Year-4.

4) What are the eligibility criteria?

TU requires 10+2 or equivalent with English as a full paper and the minimum marks set by TU or the campus; many campuses apply second division (≥45%) or CGPA ≥1.8.

5) Does the program include fieldwork or a project?

Yes. Students complete a four-week field study and submit a final project evaluated by internal and external examiners.

6) Are scholarships available?

BST offers GPA-linked fee waivers, an entrance-topper scholarship, and need-based support. Check the latest intake notice.

7) What facilities support BBS learning?

Library access, computer/ICT lab, auditorium for talks, and other campus facilities that help with presentations and research activities.