Overview

ACCA at Certified College of Accountancy (CCA), Kathmandu

Certified College of Accountancy (CCA), located in Thapagaun, New Baneshwor, Kathmandu, offers one of Nepal’s most recognized pathways to earning the globally respected ACCA qualification. Known for its practical learning approach and a track record of producing capable finance professionals, CCA remains popular among students in accounting, auditing, and financial management careers.

The ACCA (Association of Chartered Certified Accountants), headquartered in the UK, is a professional body recognized in over 180 countries. CCA’s affiliation with this global qualification allows students in Nepal to access international standards in accounting and finance education, without needing to travel abroad.

This article provides a comprehensive overview of the ACCA qualification at CCA, including scope, course structure, intakes, admission process, and overall duration.

Why ACCA?

Global Recognition and Career Opportunities

The ACCA qualification opens employment opportunities in various sectors, including public accounting, corporate finance, banking, and consulting. Its recognition spans continents, allowing members to work in multinational and international accounting firms.

Professional Flexibility

Students can pursue ACCA at their own pace, offering flexibility regarding exam timing and study routes. This makes it especially suitable for balancing academic study with part-time work or other commitments.

Ethical and Technical Competency

ACCA does more than teach accounting principles—it prepares students to uphold ethical standards, analyze business environments, and solve financial problems with sound judgment. Employers value ACCA members for their practical expertise and commitment to integrity.

Scope of ACCA Qualification

ACCA covers a broad spectrum of topics relevant to today’s financial world. Below are the core areas where ACCA training prepares students:

1. Accounting and Financial Reporting

Students learn to prepare, interpret, and present financial statements according to international accounting standards, including IFRS.

2. Auditing and Assurance

The program trains students in the audit process, internal control systems, risk analysis, and regulatory compliance—skills vital for assurance professionals.

3. Taxation

ACCA includes local and international tax principles, helping students understand tax planning and compliance for individuals and businesses.

4. Financial Management

This includes budgeting, investment decisions, working capital management, capital structure planning, and financial risk assessment.

5. Strategic Business Management

ACCA students learn to evaluate business strategies, assess performance, and apply data-driven decision-making methods in real business contexts.

6. Professional Conduct and Governance

Courses emphasize ethical behavior, transparency, and regulatory responsibilities, which are critical in accounting roles.

7. Technology and Digital Skills

As finance functions evolve, ACCA integrates training in analytics, digital finance tools, and automation practices into its curriculum.

8. International Adaptability

ACCA offers a qualification that aligns with international standards, preparing students for roles in global and cross-border organizations.

Course Structure and Papers in ACCA

The ACCA qualification is divided into three main stages:

Applied Knowledge Level

This foundational stage introduces essential concepts in accounting and business.

-

Business and Technology (BT): Focuses on how businesses operate and the role of accounting in decision-making.

-

Management Accounting (MA): Teaches cost accounting, budgeting, and performance analysis.

-

Financial Accounting (FA): Covers principles of financial reporting and preparation of financial statements.

Applied Skills Level

These papers build on the fundamentals and prepare students for real-world challenges.

-

Corporate and Business Law (LW): Introduces laws governing business operations, contracts, and regulations.

-

Performance Management (PM): Focuses on planning, control, and decision-making using management accounting.

-

Taxation (TX): Explores principles and practices of tax calculations and compliance.

-

Financial Reporting (FR): Teaches the preparation of company financial reports following IFRS.

-

Audit and Assurance (AA): Trains students in audit methodology and assurance frameworks.

-

Financial Management (FM): Deals with investment analysis, capital budgeting, and funding decisions.

Strategic Professional Level

This advanced stage requires critical thinking and strategic application.

-

Strategic Business Leader (SBL): Integrates leadership, governance, and risk management with case-based learning.

-

Strategic Business Reporting (SBR): Prepares students to interpret financial reports and communicate findings to stakeholders.

-

Optional Papers (Choose Two):

-

Advanced Financial Management (AFM)

-

Advanced Performance Management (APM)

-

Advanced Taxation (ATX)

-

Advanced Audit and Assurance (AAA)

-

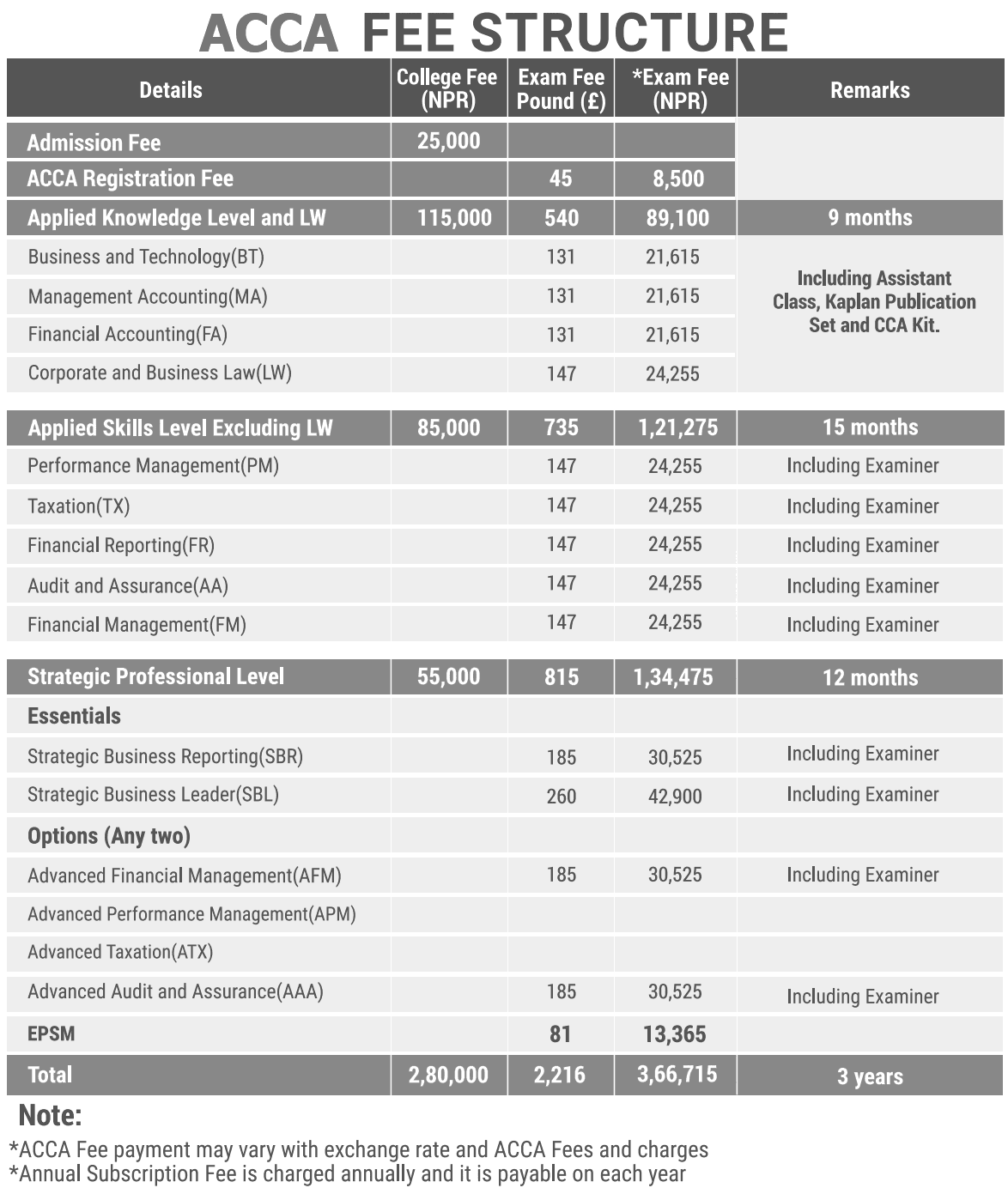

ACCA Fee Structure at CCA

| Details | College Fee (NPR) | Exam Fee Pound (£) | *Exam Fee (NPR) | Remarks |

|---|---|---|---|---|

| Admission Fee | 25,000 | |||

| ACCA Registration Fee | 45 | 8,500 | ||

| Applied Knowledge Level and LW | 115,000 | 540 | 89,100 | 9 months |

| Business and Technology (BT) | 131 | 21,615 | Including Assistant Class, Kaplan Publication Set and CCA Kit. | |

| Management Accounting (MA) | 131 | 21,615 | ||

| Financial Accounting (FA) | 131 | 21,615 | ||

| Corporate and Business Law (LW) | 147 | 24,255 | ||

| Applied Skills Level Excluding LW | 85,000 | 735 | 1,21,275 | 15 months |

| Performance Management (PM) | 147 | 24,255 | Including Examiner | |

| Taxation (TX) | 147 | 24,255 | Including Examiner | |

| Financial Reporting (FR) | 147 | 24,255 | Including Examiner | |

| Audit and Assurance (AA) | 147 | 24,255 | Including Examiner | |

| Financial Management (FM) | 147 | 24,255 | Including Examiner | |

| Strategic Professional Level | 55,000 | 815 | 1,34,475 | 12 months |

| Essentials | ||||

| Strategic Business Reporting (SBR) | 185 | 30,525 | Including Examiner | |

| Strategic Business Leader (SBL) | 260 | 42,900 | Including Examiner | |

| Options (Any two) | ||||

| Advanced Financial Management (AFM) | 185 | 30,525 | Including Examiner | |

| Advanced Performance Management (APM) | ||||

| Advanced Taxation (ATX) | ||||

| Advanced Audit and Assurance (AAA) | 185 | 30,525 | Including Examiner | |

| EPSM | 81 | 13,365 | ||

| Total | 2,80,000 | 2,216 | 3,66,715 | 3 years |

Note:

-

*ACCA Fee payment may vary with exchange rate and ACCA Fees and charges

-

*Annual Subscription Fee is charged annually and it is payable on each year

Ethics and Professional Skills Module

Beyond exams, ACCA candidates must complete an ethics module to promote integrity, objectivity, and professional behavior—an integral part of becoming an ACCA member.

Intake Schedule at CCA

CCA offers four ACCA intakes each year:

-

March Intake

-

June Intake

-

September Intake

-

December Intake

This quarterly intake system allows students to begin their studies at a time that suits them best. Whether students are coming from school, transferring from another institution, or planning a career shift, the multiple intakes allow convenient enrollment.

Students are advised to consult directly with the CCA administration or visit their official website for accurate dates and deadlines.

Admission Process at CCA

Basic Requirements

-

No prior accounting background or entrance test is required.

-

Students who have completed +2 (Grade 12) or equivalent can apply.

-

There are no age restrictions or experience prerequisites.

Application Process

-

Fill out the ACCA admission form available at CCA.

-

Submit the required documents:

-

Academic transcripts

-

Citizenship or passport copy

-

Recent passport-size photographs

-

-

Pay the applicable admission fee.

The process is straightforward and allows students from diverse academic backgrounds to pursue professional education in finance and accounting.

Course Duration

The timeline to complete the ACCA qualification depends on how quickly a student progresses through the exams and gains work experience.

Estimated Timeline

-

Applied Knowledge & Skills Levels: ~2 years

-

Strategic Professional Level: ~1 year

-

Practical Experience Requirement (PER): 3 years (can be completed alongside studies)

Most students complete the qualification in 3 to 4 years, depending on personal pace and exam success.

Practical Experience Requirement (PER)

To become a certified ACCA member, candidates must fulfill a minimum of 36 months of relevant supervised work experience. This experience should be in a finance, audit, or accounting role and must meet ACCA’s defined performance objectives.

Students are encouraged to document their work progress using ACCA’s online PER tool, which helps them track technical and interpersonal skills development.

Learning Support at CCA

CCA offers structured learning and mentorship designed to help students succeed.

Classroom and Online Learning

-

Access to qualified instructors with real-world accounting experience

-

Regular revision classes and test series

-

Recorded video lectures and digital study materials

Mock Tests and Mentoring

CCA organizes mock exams under exam-like conditions, helping students prepare effectively. One-on-one mentoring is also available to guide students' academic and career decisions.

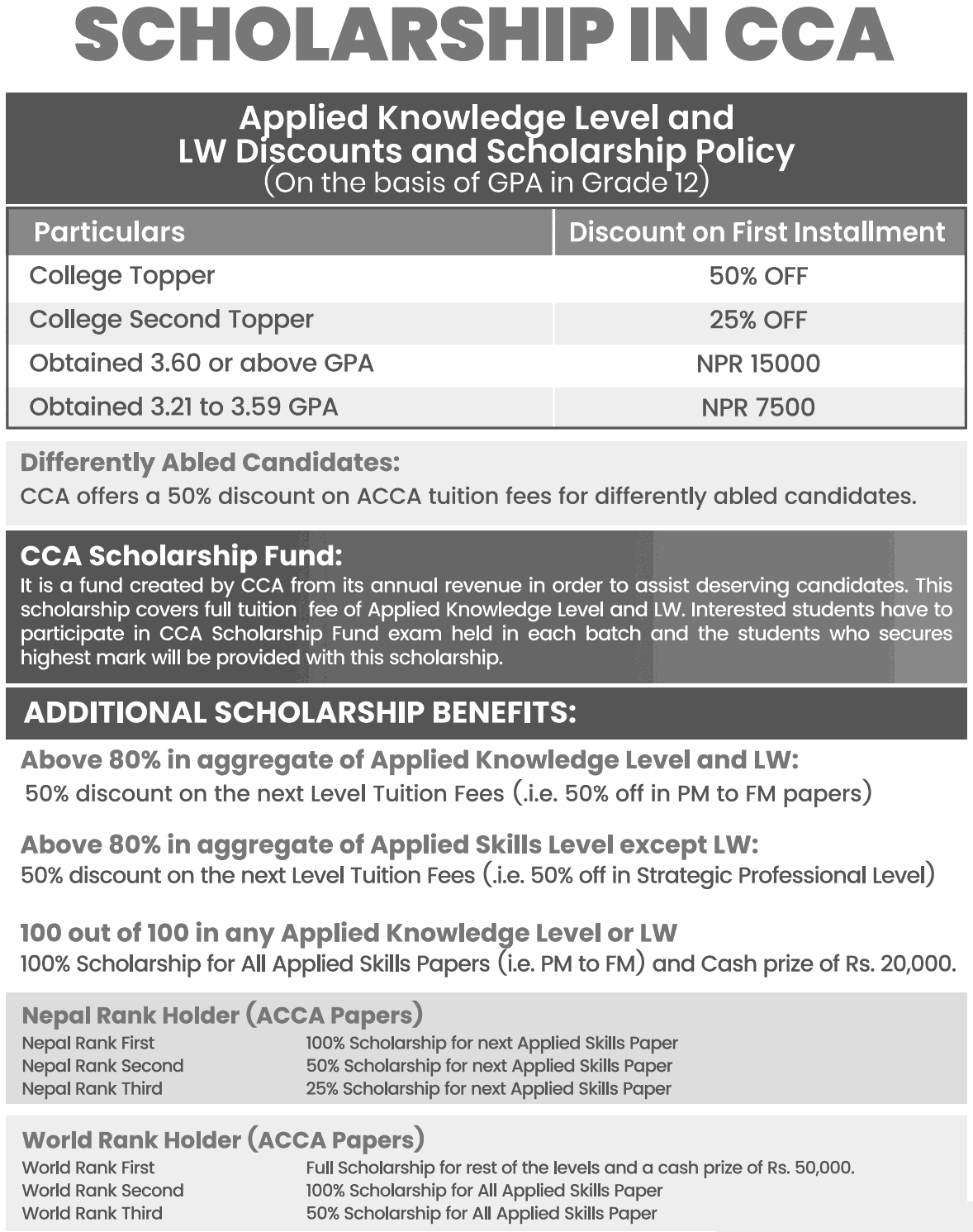

Scholarship Opportunities at CCA

CCA supports student achievement through several scholarships:

The total cost of completing the ACCA program at CCA is around NPR 6.45 lakhs, making it one of the most budget-conscious options in Nepal. But beyond affordability, we offer a range of scholarships designed to reward academic achievement and support students from diverse backgrounds.

-

+2 High Achievers: Students who scored a GPA of 3.21 to 3.59 in their +2 exams will receive a tuition fee reduction of NPR 7,500 for the first level. Those with a GPA of 3.60 or above will receive NPR 15,000 off. College second toppers are eligible for a 25% discount, while college toppers will receive a 50% discount.

-

Quarterly Scholarship Fund Exam: We organize a competitive exam through the CCA Scholarship Fund every three months. The winner earns a scholarship of approximately NPR 115,000, covering tuition fees for Applied Knowledge Level and Law (LW).

-

Support for Differently Abled Students: We offer a 50% tuition discount to students with disabilities. We believe that talent deserves opportunity, regardless of personal circumstances.

-

Exemption Background Discount: Students coming from academic backgrounds such as Bachelor's, Master’s, ICAN, or ICAI receive a 50% admission fee waiver.

These scholarships aim to support deserving and underrepresented students in their journey toward global qualifications.

Career Outcomes After ACCA

Graduates of the ACCA program at CCA have gone on to pursue roles such as:

-

Financial Analyst

-

Internal Auditor

-

External Auditor

-

Management Accountant

-

Tax Advisor

-

Finance Manager

-

CFO or Partner at Accounting Firms

ACCA membership is not just about a title—it’s a mark of professional competence that opens opportunities in multinational corporations, NGOs, government sectors, and private businesses.

Conclusion

Pursuing ACCA at the Certified College of Accountancy (CCA), Kathmandu, is a solid choice for anyone serious about a career in finance or accounting. With a curriculum rooted in global standards, expert faculty, flexible intakes, and practical experience opportunities, students are well-prepared for the demands of the modern financial world.

Students should contact CCA's academic office or official communication channels for accurate updates, fee structure, and guidance.