Commercial Banks' Profit Decreased by 12 Percent:

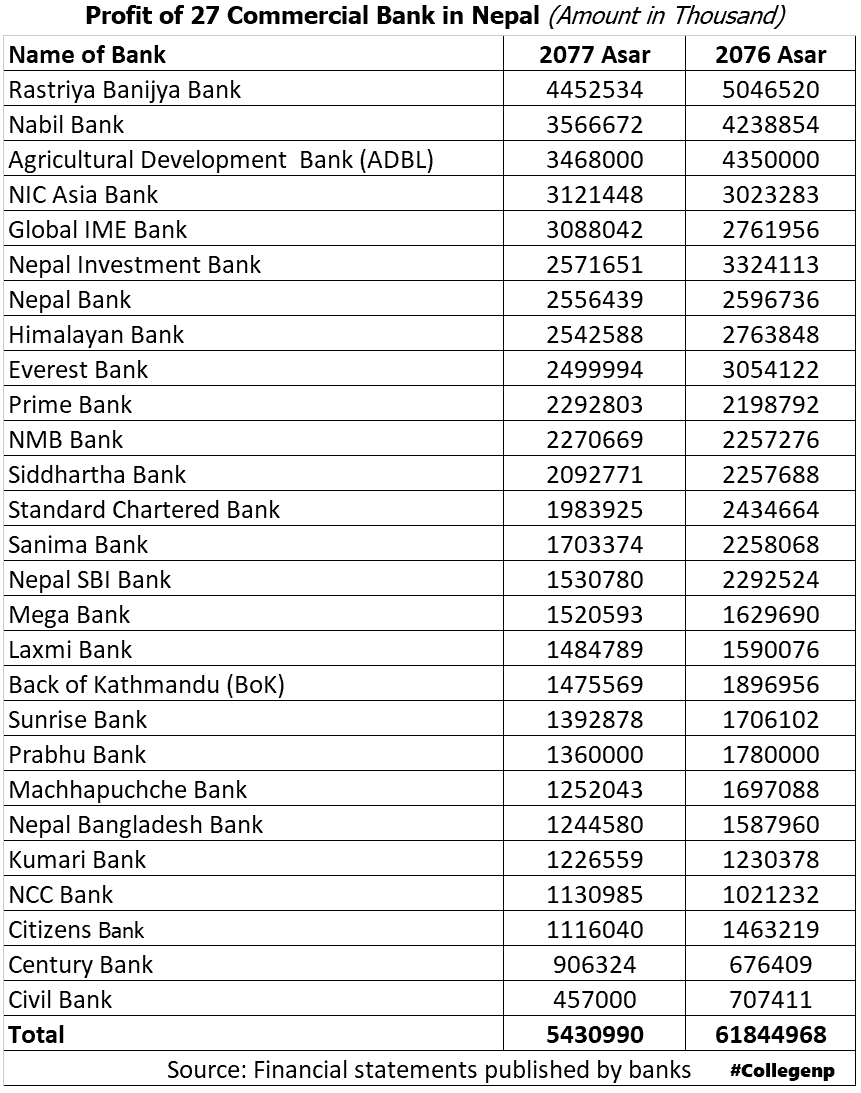

According to the unaudited financial statements published by the banks, the total profit of commercial banks in the last fiscal year was Rs. 54.30 billion. Compared to the previous year, it has decreased by about 12 percent. Such profit of the bank was Rs. 61.84 billion in the previous fiscal year. Banks said profits fell as businesses were affected by the downturn to avoid the risk of COVID-19. The impact of the global corona has been felt in the banking sector as well. Without it, the profits of some banks would have been negative.

As in other sectors of the economy, the impact of COVID-19 has directly affected the profits of banks. That is why the total net profit of 27 commercial banks has declined by 12 percent in the last fiscal year. Such profit had increased by 25 percent in the previous fiscal year.

Distributable income is the amount that banks distribute to shareholders as dividends. Such income of banks has declined by about 41 percent in the last fiscal year. In the previous fiscal year, banks had been distributing good dividends on average. Of the 27 commercial banks in operation, distributable profits of all except Prime and NMB also declined, according to the financial statement.

According to the situation, the profit of the banks has been good in the last fiscal year, says Ashok Sherchan, Chief Executive Officer of Prabhu Bank. "It was a negative situation. The flexible policy system of the NRB has enabled the bank to make such a profit," he said. "The current profit is satisfactory under difficult circumstances."

Anil Kumar Upadhyaya, chief executive officer of the Agriculture Development Bank, said that the bank's profit has declined due to the inability to conduct a recovery program in the middle of the fiscal year due to Corona. In comparison, there is a lot of population in the Terai region of Nepal. There is a lot of debt in those areas. However, he said that the bank's profit has declined as those areas have been more affected due to Kovid. "In the case of the Agriculture Development Bank, the number two state has announced an interest waiver for Kovid victims," ââhe said. "After this announcement, the non-payment of loans has increased in the Terai."

"Profits have declined due to the impact of COVID-19 on the economy and the NRB has reduced the interest spread between loans and deposits," said Roshan Neupane, chief executive officer of NIC Bank. It has a direct impact on the profits of the banks, ”he said, adding that many businesses have been badly affected by Kovid and it will take time for them to return to normalcy. "The current fiscal year is even more challenging for the bank," he said, adding that "the bank will have to do business in the midst of this turmoil." "This is an indication of the bank's potential for profit in the current fiscal year," he said.

Compared to the previous year, the net profit of all the banks except five has decreased in the last fiscal year. Even in difficult circumstances, the net profit of five banks is more than Rs 3 billion. Of that, Rastriya Banijya Bank has a net profit of Rs 4.45 billion. Such profit was Rs 5.4 billion in the previous fiscal year. Similarly, Nabil has become the second most profitable bank with a net profit of Rs 3.56 billion. The Agriculture Development Bank is the third most profitable bank. Its net profit is Rs 3.46 billion. NIC Asia Bank is fourth with a profit of Rs 3.12 billion and Global IME Bank is fifth with a profit of Rs 3.8 billion. Including this, the net profit of 12 banks is more than Rs 2 billion. Last year, the net profit of all the banks except Civil and Century was more than one billion rupees. However, the net profit of the Civil Bank is Rs 457 million and that of Century Bank is Rs 904.3 million. Compared to the previous year, the profit of civil has decreased while that of the Century Bank has increased.

As per the NRB directive, the banks that gave a 10 percent interest discount to the debtors affected by the impact of COVID-19 last April have reduced the interest rate by 2 percent from April to July. Debtors who are unable to repay the loan have not paid the loan installment and interest. Experts say that the bank's profit has decreased significantly due to the need to make provision of 5 percent while restructuring the uncollectible loans.

Despite the decline in profits, banks' deposits have increased by about 24 percent in the last fiscal year. Credit flow increased by 20.37 percent during the same period. The base interest rate of banks has declined during the same period. This means that the interest on all new and old loans should be reduced. The financial statements have shown that the return on assets (ROE) of all the banks has decreased in the last fiscal year as compared to the previous year.

A statement as per Bank (Amount in Thousand):

| Name of Bank | 2077 Asar | 2076 Asar |

| Rastriya Banijya Bank | 4452534 | 5046520 |

| Nabil Bank | 3566672 | 4238854 |

| Agricultural Development Bank (ADBL) | 3468000 | 4350000 |

| NIC Asia Bank | 3121448 | 3023283 |

| Global IME Bank | 3088042 | 2761956 |

| Nepal Investment Bank | 2571651 | 3324113 |

| Nepal Bank | 2556439 | 2596736 |

| Himalayan Bank | 2542588 | 2763848 |

| Everest Bank | 2499994 | 3054122 |

| Prime Bank | 2292803 | 2198792 |

| NMB Bank | 2270669 | 2257276 |

| Siddhartha Bank | 2092771 | 2257688 |

| Standard Chartered Bank | 1983925 | 2434664 |

| Sanima Bank | 1703374 | 2258068 |

| Nepal SBI Bank | 1530780 | 2292524 |

| Mega Bank | 1520593 | 1629690 |

| Laxmi Bank | 1484789 | 1590076 |

| Back of Kathmandu (BoK) | 1475569 | 1896956 |

| Sunrise Bank | 1392878 | 1706102 |

| Prabhu Bank | 1360000 | 1780000 |

| Machhapuchche Bank | 1252043 | 1697088 |

| Nepal Bangladesh Bank | 1244580 | 1587960 |

| Kumari Bank | 1226559 | 1230378 |

| NCC Bank | 1130985 | 1021232 |

| Citizens | 1116040 | 1463219 |

| Century Bank | 906324 | 676409 |

| Civil Bank | 457000 | 707411 |

| Total | 5430990 | 61844968 |

| Source: Financial statements published by banks | ||