.png)

Eighth Social Security Day 2082 – Special

Eighth Social Security Day 2082 highlights Nepal’s contribution-based social security system under the theme “Social Security: Access to Universal Health Services, a Pensionable Society and Productivity Growth with Protection of Citizens’ Lives.” Messages from the Prime Minister, the Ministry and the Social Security Fund (SSF Nepal) stress social justice, wider coverage of formal, informal and foreign employment workers, and schemes that offer health care, disability and old-age pensions, dependent family support, and related financial facilities through regular contributions.

Message from the Prime Minister

Greeting Message from PM Sushila Karki on the Occasion of the Eighth Social Security Day

It has been eight years since Nepal implemented contribution-based social security schemes through the Social Security Fund (Samajik Suraksha Kosh). As we observe Social Security Day every year on Mangsir 11, this year we are marking the day with the main slogan “Social Security: Access to Universal Health Services, a Pensionable Society and Productivity Growth with Protection of Citizens’ Lives.” On this occasion, I extend heartfelt best wishes to all workers and all citizens residing in the country and abroad.

The social security system is regarded as a major foundation of social justice. In line with the Contribution-based Social Security Act, 2074, the Social Security Fund has advanced various schemes with the objective of ensuring the right of workers to contribution-based social security, providing social security to contributors by bringing all workers under social security schemes, reducing their economic and social risks, giving concrete form to the concept of universal social security, and ensuring the constitutional right to contribution-based social security.

With effective implementation of these social security schemes, it is expected that every citizen will have easy access to quality health services, that continuity of income will be ensured even amid various disabilities and vulnerabilities at different stages of life, that a pension system based on sustainable resources will be strengthened, and that national productivity will increase through domestic capital formation. Along with this, it is expected that trust and confidence in the state will grow among the youth and all citizens.

The social security system is an important bridge between the state and citizens. To further strengthen this bridge, broad participation of workers in the formal and informal sectors, self-employed persons and Nepali citizens engaged in foreign employment is indispensable. I believe that this will help fulfil our national commitment to build an “integrated, sustainable and capable social security system.”

Finally, I would like to express heartfelt thanks to all employers and contributors within the country and abroad who have participated in the social security schemes operated by the Social Security Fund, as well as to all public employees, social security campaigners, organisations and all sisters and brothers engaged in implementing the schemes. With the wish that in the coming days all citizens will participate in social security schemes and that the social security system will make an important contribution to building a prosperous Nepal, I extend my best wishes for the success of this programme.

Message from the Ministry

Government of Nepal, Ministry of Labour, Employment and Social Security, Singha Durbar, Kathmandu, Nepal, Greeting Message on the Occasion of the Eighth Social Security Day.

Today, Mangsir 11, the Eighth Social Security Day is being observed throughout the country with the main slogan “Social Security: Access to Universal Health Services, a Pensionable Society and Productivity Growth with Protection of Citizens’ Lives.” On this occasion, I extend heartfelt thanks and best wishes to all employers and contributors within the country and abroad.

In accordance with the Contribution-based Social Security Act, 2074, the Social Security Fund was established to ensure the right of all workers to contribution-based social security and to provide social security to contributors. The contribution-based social security schemes operated by the Fund ensure sources on a sustainable basis and provide protection by reducing all types of risks during the working period of contributors, as well as ensuring continuity of income even in life after retirement.

Workers from the formal and informal sectors, as well as self-employed persons, contribute a certain percentage of their income to the Fund. In return for these contributions, the Fund has been implementing contribution-based social security programmes such as treatment in case of illness or accident, pension in case of disability and upon the death of an income-earning person, lifelong pension for the contributor and dependent family members, and retirement pension benefits in old age. As a foundation for access to social security for all, successful implementation of contribution-based social security programmes can support the achievement of an equitable society and a socialism-oriented economy as envisioned by the Constitution. Therefore, I make a heartfelt call to all employers, workers and self-employed persons to join the Social Security Fund and benefit from it.

Finally, I express heartfelt thanks to all who have contributed to the success of contribution-based social security programmes. With the expectation that this day will provide further encouragement and energy for everyone to join social security schemes and secure their present and future, I once again extend my sincere best wishes.

(Dr. Krishna Hari Pushkar) - Secretary, Ministry of Labour, Employment and Social Security

and Chairperson, Social Security Fund Board of Directors

Message from the Social Security Fund

Government of Nepal, Ministry of Labour, Employment and Social Security, Social Security Fund, Thapathali, Kathmandu, Commitment from the Executive Director.

On the occasion of this Eighth Social Security Day, being observed with the main slogan “Social Security: Access to Universal Health Services, a Pensionable Society and Productivity Growth with Protection of Citizens’ Lives,” I extend respectful greetings and heartfelt best wishes, on behalf of the Fund, to the Government, employers, workers and all stakeholders who have supported the inception, development and expansion of Nepal’s overall social security system and the Social Security Fund.

Within a short period of eight years, social security programmes have brought workers and self-employed persons from the formal, informal, self-employment and foreign employment sectors, as well as employees of public bodies, under the broad framework of contribution-based social security. For contributors who are affiliated with the Fund and make regular contributions, the Fund provides facilities such as medical treatment, health and maternity protection for the contributor and spouse, treatment for critical illnesses of the contributor, treatment for accidents, disability pension, dependent family protection, old age security and contributor loan facilities. The number of contributors affiliated with the Fund has reached 2,647,471, and the total amount of contributions collected has reached 95.68 billion rupees. An amount of 17.72 billion rupees has already been disbursed against use of facilities provided by the Fund, and the number of beneficiaries who have used these facilities is 253,143.

The Fund has given high priority to service delivery through an online system. Health facilities provided by the Fund are being delivered through 107 health institutions systematically affiliated with the Fund, and this number will continue to increase. With the objective of decentralising the facilities provided by the Fund, offices have already been established in Biratnagar, Simara, Butwal, Nepalgunj, Pokhara and Janakpur, and arrangements will be made to expand service delivery by opening offices in Dhangadhi and Surkhet in the coming days. The Fund remains committed to upholding institutional good governance, implementing an effective internal control system, and delivering services in a manner friendly to contributors and employers.

Finally, we express our thanks to all tiers of government, various labour organisations, employer organisations, different ministries, employees, the International Labour Organization and other development partners, and all concerned for the guidance, suggestions, advice and support received in making contribution-based social security programmes successful. With the expectation of similar support and guidance in the coming days as well, we once again extend our best wishes to all on the occasion of Social Security Day. - Kaviraj Adhikari - Executive Director

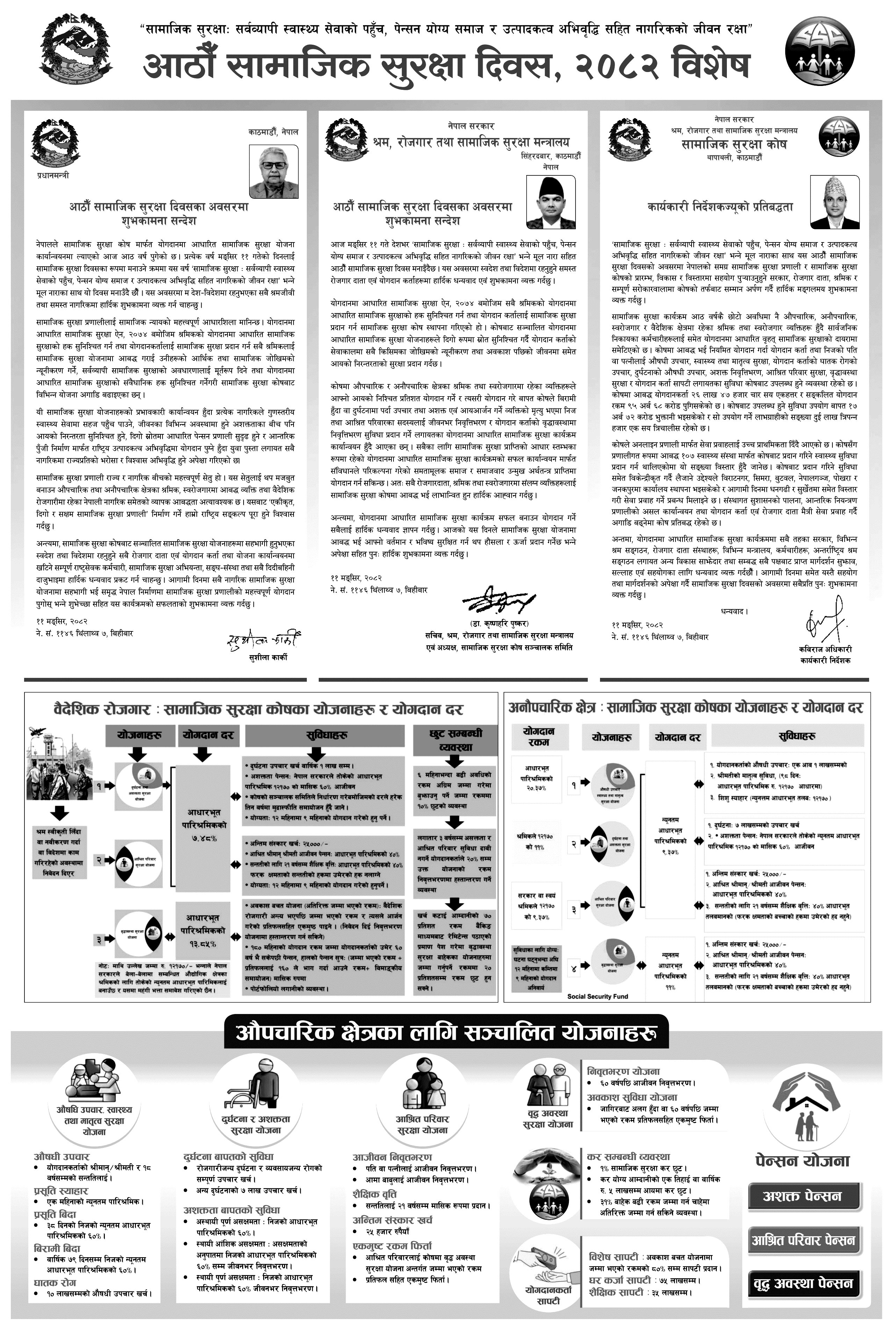

Schemes and Contribution Rates

Foreign Employment: Social Security Fund Schemes and Contribution Rates

1. Plan: Accident and Disability Security Plan / Dependent Family Security Plan

-

Contribution rate: 7.48% of basic salary

-

Benefits:

-

Accident treatment expenses up to 100,000 per year.

-

Disability pension: 60% per month of the basic salary of 11,930 fixed by the Government of Nepal, for life.

-

Adjustment for inflation every three years at the rate determined by the Fund’s Board of Directors.

-

Eligibility: Must have contributed for 9 months within a period of 12 months.

-

Funeral expense: 25,000.

-

Lifelong pension for dependent husband or wife at 40% of basic salary.

-

Educational scholarship for children up to 21 years of age at 40% of basic salary.

-

No age limit applies in the case of children with disabilities.

-

-

Provisions related to discounts:

-

If contributions for a period of more than 6 months are deposited in advance, a 10% discount is provided on the total amount payable.

-

2. Plan: Old Age Security Plan

-

Contribution rate: 13.65% of basic salary (total deposit 21.13% of basic salary)

-

Benefits:

-

Retirement savings plan (additional amounts deposited): after the end of foreign employment, the accumulated amount together with returns earned is received as a lump sum. (Upon application, it can be transferred to the pension plan.)

-

After contributing for 180 months and once the contributor reaches 60 years of age, pension is provided according to the current pension formula: (total accumulated amount plus returns divided by 160 plus actuarial adjustment), on a monthly basis.

-

Arrangement for portfolio investment.

-

-

Provisions related to discounts:

-

Contributors who do not claim disability and dependent family benefits for three consecutive years may transfer up to 20% of the amount of this plan to the pension plan.

-

If proof is submitted that 70% of income after deducting expenses has been remitted through banking channels, up to 20% discount may be granted on the amount to be deposited under schemes other than the Old Age Security Plan.

-

Note: The total amount of Rs 11,930 mentioned above refers to the minimum basic salary prescribed from time to time by the Government of Nepal for workers in the respective industrial sectors, and does not include allowances for inflation.

Informal Sector: Social Security Fund Schemes and Contribution Rates

1. Plan: Medical Treatment, Health and Maternity Protection Plan

-

Contribution amount: 20.37% of basic salary

-

Contribution rate: 1%

-

Benefits:

-

Medical treatment for the contributor: up to 100,000 per fiscal year.

-

Maternity benefit for spouse (98 days, based on basic salary of Rs 11,930).

-

Childcare benefit (based on the minimum basic salary of 11,930).

-

2. Plan: Accident and Disability Security Plan

-

Contribution amount: The worker contributes 11% of 11,930.

-

Contribution rate: 1.40%

-

Benefits:

-

Accident treatment expenses up to 700,000.

-

Disability pension: 60% per month of the minimum basic salary of 11,930 fixed by the Government of Nepal, for life.

-

3. Plan: Dependent Family Security Plan

-

Contribution amount: The government or the worker themself pays 9.37% of 11,930.

-

Contribution rate: 0.27%

-

Benefits:

-

Funeral expense: 25,000.

-

Lifelong pension for dependent husband or wife at 40% of basic salary.

-

Educational scholarship for children up to 21 years of age at 40% of the basic salary level (no age limit in the case of a child with disabilities).

-

4. Plan: Old Age Security Plan

-

Contribution rate: 17.70%

-

Benefits:

-

Funeral expense: 25,000.

-

Lifelong pension for dependent husband or wife at 40% of basic salary.

-

Educational scholarship for children up to 21 years of age at 40% of the basic salary level (no age limit in the case of a child with disabilities).

-

Eligibility for benefits: At least 9 months of contribution within the 12 months prior to the occurrence of the event is mandatory.

Formal Sector

Schemes Operated for the Formal Sector

Medical Treatment, Health and Maternity Protection Plan

-

Medical treatment: for the contributor’s husband or wife and children up to 18 years of age.

-

Maternity care: the minimum of one month’s basic salary.

-

Maternity leave: 60% of the person’s minimum basic salary for 38 days.

-

Sick leave: 60% of the person’s minimum basic salary for up to 79 days per year.

-

Life-threatening disease: medical treatment expenses up to 1,000,000.

Accident and Disability Security Plan

-

Benefit for accident: in case of temporary total disability, 60% of the person’s basic salary.

-

Treatment expenses up to 700,000 for other accidents.

-

Benefit for disability:

-

Temporary total disability: 60% of the person’s basic salary.

-

Permanent partial disability: lifelong pension up to 60% of the person’s basic salary, in proportion to the degree of disability.

-

Permanent total disability: lifelong pension at 60% of the person’s basic salary.

-

Dependent Family Security Plan

-

Lifelong pension:

-

Lifelong pension to husband or wife.

-

Lifelong pension to parents.

-

-

Educational scholarship: provided monthly to children up to 21 years of age.

-

Funeral expenses: 25,000 rupees.

-

Lump sum refund: to the dependent family, the amount accumulated in the Fund under the Old Age Security Plan, together with returns, is refunded as a lump sum.

Old Age Security Plan

-

Pension plan: lifelong pension after 60 years of age.

-

Retirement benefit plan: when separating from employment or after 60 years of age, the accumulated amount is refunded as a lump sum with returns.

Tax-related Provisions

-

1% social security tax exemption.

-

Tax deduction on up to one-third of taxable income or up to Rs 500,000 per year.

-

Provision to deposit additional amounts exceeding 31%, if desired.

Special Loan Facilities

-

Special loan: up to 80% of the amount accumulated in the retirement savings plan.

-

Home loan: up to 7,500,000.

-

Education loan: up to 3,500,000.

Pension Plans

-

Disability pension

-

Dependent family pension

-

Old age pension