Nepal Bank Limited 84th Anniversary:

Nepal Bank Limited has been celebrating the 84th anniversary. On this auspicious occasion, the Chief Executive Officer (CEO) of Nepal Bank Limited (NBL) has presented a summary of Bank activities.

Banking Estates of Nepal: Nepal Bank Limited (written by CEO of NBL)

Banking Estates:

Nepal Bank, which was established on the 30th of Kartik, 1297 BS, has completed its eight-decade tenure as a financial institution providing essential banking services in addition to providing financial resources for industrial, commercial, and commercial activities by launching banking services in Nepal. Nepal Bank Limited, which has been identified as Nepal Bank in the vernacular, has been established as the banking heritage of Nepal.

First bank in 84 years:

I would like to thank all the shareholders, the Government of Nepal, the Board of Directors, the depositors, the benefactors, and the well-wishers on the occasion of the 83rd anniversary of Nepal Bank Limited, the house of Nepal's banking history. I would like to extend my heartfelt congratulations and best wishes to all. I have taken this historic moment as a celebration to receive new credit.

203 Branch Network:

As the bank enters its 84th year, the branch network has expanded to 203. We are also preparing to open 11 more branches within this fiscal year. We have reached 77 districts as soon as possible with the aim of providing banking services and facilities to all Nepali citizens. Our priority is to reach all the district headquarters, but we are also reaching out to the villages with commercial potential. We are with the Government of Nepal in its campaign to extend banking access to all Nepalis. Hako is actively involved in the bank account campaign of every Nepali.

Strong financial institutions:

Troubled by the problems seen in institutional good governance in the 2040 BS, the bank has regained its natural rhythm by overcoming financial problems due to the relentless efforts and impact of institutional reforms initiated through the financial sector reform program.

Based on the financial statements, Nepal Bank Limited has been transformed into a strong institution. Adopting the latest style of management and business in the changing global and national environment, technology, and competition, it is formulating various policies, planning, and conducting banking programs to increase financial expansion, inclusion, and banking access.

Practicing a new work culture:

Various risks that can be created due to the lack of good policy in the bank have been reduced. Along with lyrical clarity, new work culture has been developed in which employees make timely decisions and first priority in customer service quality. With the increase in customer service quality, it has become the identity of the bank with simple, easy, and quality service. The importance of the technology used to make business expansion faster, safer, and simpler has increased in the current Coronavirus epidemic. By making extensive changes in the working style of the employees, it has been established to give priority to customer service during office hours and to hold institutional internal programs or meetings before or after office hours. Dedicated to customer service, disciplined, diligent, hardworking, with the determination to make the bank the first choice of the citizens with good corporate governance, the team with new leadership is operating the bank embracing the new work culture.

Banks lending at low-interest rates:

As it is the first bank in Nepal and associated with the name of the country, it is believed that this bank should be able to inspire others. The bank has succeeded in winning the trust of all with the protection and satisfaction of the customer's property by providing efficient service at a low cost.

We are gaining immense trust and confidence from the government and the people. We have identified low-interest-rate lending banks. There is a high priority to provide low-cost banking services to the general public and to assist in the implementation of the government's fiscal policy. The bank has already provided interest relief of around Rs 400 million to the businesses affected by the Corona epidemic which is affecting the entire world. We have taken it as our duty to help in difficult times even if we have to spend our profits. At present, we are in a position to refinance the equivalent of Rs 4.40 billion. This facility has been made available to all the small debtors most affected by the Corona epidemic. Through this acre of relief and facilities, we will contribute to the business revival and economic growth.

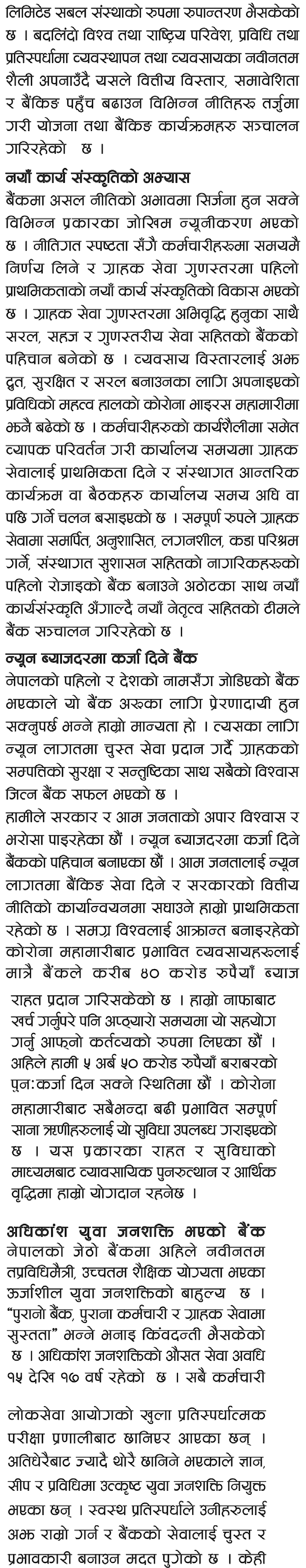

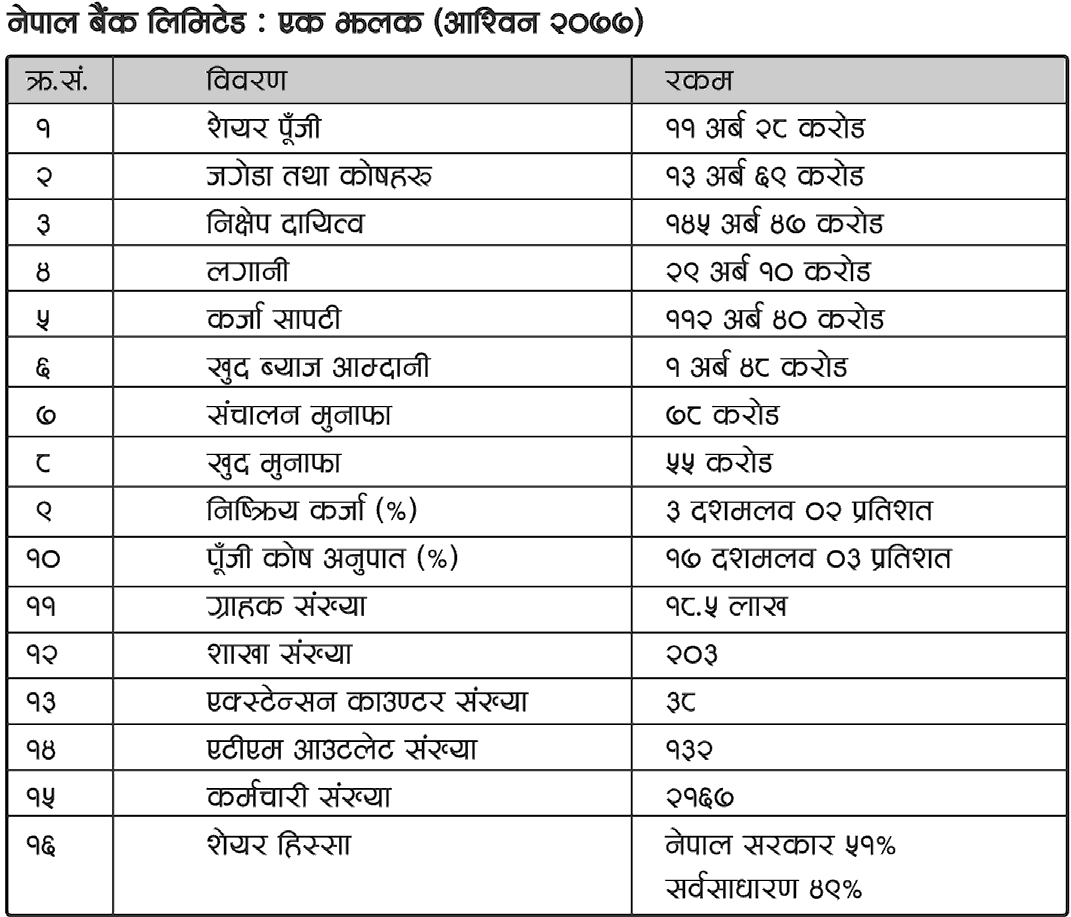

Nepal Bank Limited: A Glimpse (Ashwin 2077)

| Share capital | 11.28 billion |

| Reserves and funds | 13.62 billion |

| Deposit liability | 145.47 billion |

| Investment | 29.10 billion |

| Loans | 112.40 billion |

| Net interest income | 1.48 billion |

| Operating profit | 780 million |

| Net profit | 540 million |

| Non-performing loan (%) | 3.02 percent |

| Capital ratio (%) | 17.03 percent |

| Total number of customers | 184 lakhs |

| Total Branch No. | 203 |

| Total extension counter | 38 |

| Total ATM Outlet | 132 |

| Total staff | 2167 |

| Government of Nepal share | 51% |

| General Public Share | 49% |

Most young manpower:

The oldest bank in Nepal, which has a majority of young manpower, is now dominated by the latest technology-friendly, energetic young manpower with the highest educational qualifications. The average service life of most of the manpower is 15 to 17 years. All the employees have been selected through the open competitive examination system of the Public Service Commission.

Excellent young manpower in knowledge, skill, and technology has been appointed as very few will be selected from the very majority. Healthy competition has helped them to do better and make the bank's services efficient and effective. We have been conducting various types of training and capacity building programs from time to time for the specialized knowledge required for certain types of customized technology. Therefore, even though it is the oldest bank in the country, we are working as a youth bank in terms of manpower.

Use of state-of-the-art information technology:

We have been providing state-of-the-art banking system services available in the market. Internet Banking, Mobile Banking, ATM, QR, POS, RTGS, ConnectIPS, Debit Card, and all other services are available.

The process of approving loans through electronic means has already started. The bank account opening facility is available online. We have gone through the process of using and automating all the latest technologies available in our banking sector. Similarly, we are preparing to add more technical features to our customers.

Dimensions of improvement and priority:

Institutional good governance is one of the key areas of bank reform. The second is structural and systemic improvement while the third is automation, digitization along core banking software. As a result, increasing the quality of customer service and expanding the network is a priority. Continuing to increase the capacity, efficiency, and skills of the employees are also one of the priorities.

Within the structural system of the bank, there are a head office and its various departments, divisions, provincial offices and subordinate branches. We have started the Organization and Management Survey to further clarify the division of the head office and its functions and responsibilities. Based on the results and recommendations, we will immediately improve the structural system.

Such surveys, studies, and researches are also a priority to keep the banking market of Nepal afloat by embracing the changes in the changing world market.

Debt expansion:

Credit expansion is always a priority for all banks. But due to the Kovid epidemic, new loan proposals are rare. The bank has paid special attention to epidemic-less affected areas such as agriculture, trade, food production, and information technology. Now that the demand for loans is low and there is ample liquidity, we are in a position to provide loans at low-interest rates. The demand for concessional loans and other business loans brought by the government is increasing and we have also focused on that.

Risk reduction

There is risk in the entire business of the bank including operation, currency mobilization, and credit. To reduce such risks, employees need to increase their knowledge, skills, and abilities. Debt valuation and review procedures need to be followed effectively. This is the first immunity to reduce bank risk. The first siege is managed by the second if no risk is identified. Implementation of advice and suggestions from the Department of Risk Management also helps in risk reduction.

This department is the second circle of immunity. Another area of âârisk is technology-based banking. The risk from technology can be very large, and such risks can be reduced without the immune system signaling. To reduce such risks, we are investing heavily in technical immunity. In addition, inspection and internal auditors have helped in reducing risk on a regular and continuous basis. Independent (external) audits and inspections and audits by the Nepal Rastra Bank have also helped in structural empowerment in risk mitigation.